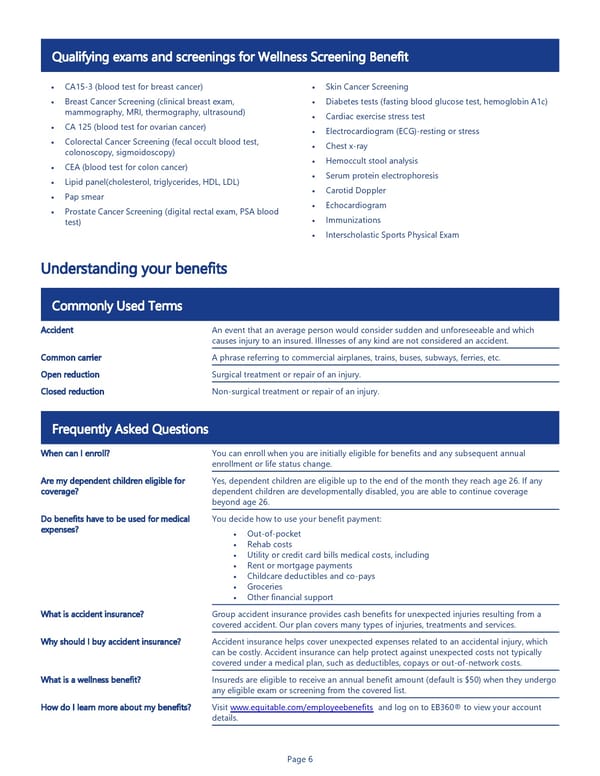

Page 6 • CA15-3 (blood test for breast cancer) • Breast Cancer Screening (clinical breast exam, mammography, MRI, thermography, ultrasound) • CA 125 (blood test for ovarian cancer) • Colorectal Cancer Screening (fecal occult blood test, colonoscopy, sigmoidoscopy) • CEA (blood test for colon cancer) • Lipid panel(cholesterol, triglycerides, HDL, LDL) • Pap smear • Prostate Cancer Screening (digital rectal exam, PSA blood test) Qualifying exams and screenings for Wellness Screening Benefit • Skin Cancer Screening • Diabetes tests (fasting blood glucose test, hemoglobin A1c) • Cardiac exercise stress test • Electrocardiogram (ECG)-resting or stress • Chest x-ray • Hemoccult stool analysis • Serum protein electrophoresis • Carotid Doppler • Echocardiogram • Immunizations • Interscholastic Sports Physical Exam Understanding your benefits Commonly Used Terms Accident An event that an average person would consider sudden and unforeseeable and which causes injury to an insured. Illnesses of any kind are not considered an accident. Common carrier A phrase referring to commercial airplanes, trains, buses, subways, ferries, etc. Open reduction Surgical treatment or repair of an injury. Closed reduction Non-surgical treatment or repair of an injury. Frequently Asked Questions When can I enroll? You can enroll when you are initially eligible for benefits and any subsequent annual enrollment or life status change. Are my dependent children eligible for coverage? Yes, dependent children are eligible up to the end of the month they reach age 26. If any dependent children are developmentally disabled, you are able to continue coverage beyond age 26. Do benefits have to be used for medical expenses? You decide how to use your benefit payment: • Out-of-pocket • Rehab costs • Utility or credit card bills medical costs, including • Rent or mortgage payments • Childcare deductibles and co-pays • Groceries • Other financial support What is accident insurance? Group accident insurance provides cash benefits for unexpected injuries resulting from a covered accident. Our plan covers many types of injuries, treatments and services. Why should I buy accident insurance? Accident insurance helps cover unexpected expenses related to an accidental injury, which can be costly. Accident insurance can help protect against unexpected costs not typically covered under a medical plan, such as deductibles, copays or out-of-network costs. What is a wellness benefit? Insureds are eligible to receive an annual benefit amount (default is $50) when they undergo any eligible exam or screening from the covered list. How do I learn more about my benefits? Visit www.equitable.com/employeebenefits and log on to EB360® to view your account details. • • • • • • • • • • • • • • • • • • • • • • • • • •

Accident Insurance Benefit Summary Page 5 Page 7

Accident Insurance Benefit Summary Page 5 Page 7