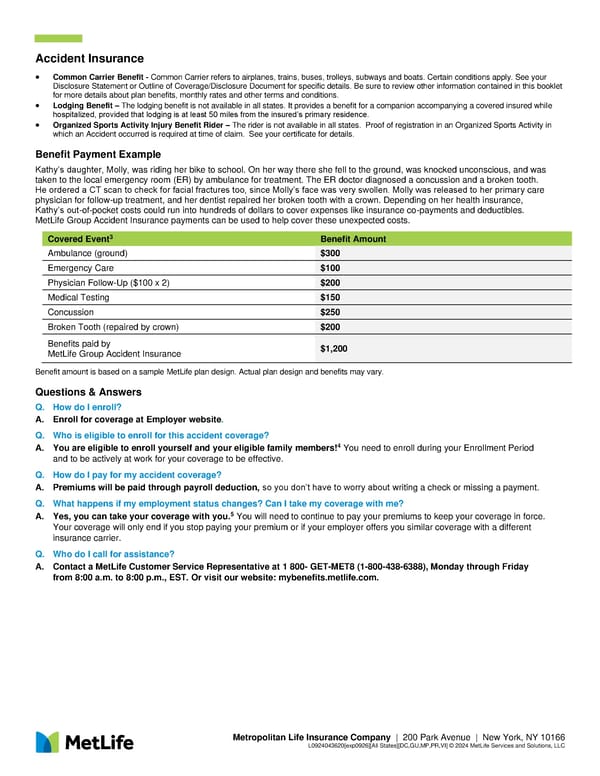

Accident Insurance Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166 L0924043620[exp0926][All States][DC,GU,MP,PR,VI] © 2024 MetLife Services and Solutions, LLC • Common Carrier Benefit - Common Carrier refers to airplanes, trains, buses, trolleys, subways and boats. Certain conditions apply. See your Disclosure Statement or Outline of Coverage/Disclosure Document for specific details. Be sure to review other information contained in this booklet for more details about plan benefits, monthly rates and other terms and conditions. • Lodging Benefit – The lodging benefit is not available in all states. It provides a benefit for a companion accompanying a covered insured while hospitalized, provided that lodging is at least 50 miles from the insured’s primary residence. • Organized Sports Activity Injury Benefit Rider – The rider is not available in all states. Proof of registration in an Organized Sports Activity in which an Accident occurred is required at time of claim. See your certificate for details. Benefit Payment Example Kathy’s daughter, Molly, was riding her bike to school. On her way there she fell to the ground, was knocked unconscious, and was taken to the local emergency room (ER) by ambulance for treatment. The ER doctor diagnosed a concussion and a broken tooth. He ordered a CT scan to check for facial fractures too, since Molly’s face was very swollen. Molly was released to her primary care physician for follow-up treatment, and her dentist repaired her broken tooth with a crown. Depending on her health insurance, Kathy’s out-of-pocket costs could run into hundreds of dollars to cover expenses like insurance co-payments and deductibles. MetLife Group Accident Insurance payments can be used to help cover these unexpected costs. Benefit amount is based on a sample MetLife plan design. Actual plan design and benefits may vary. Questions & Answers Q. How do I enroll? A. Enroll for coverage at Employer website. Q. Who is eligible to enroll for this accident coverage? A. You are eligible to enroll yourself and your eligible family members!4 You need to enroll during your Enrollment Period and to be actively at work for your coverage to be effective. Q. How do I pay for my accident coverage? A. Premiums will be paid through payroll deduction, so you don’t have to worry about writing a check or missing a payment. Q. What happens if my employment status changes? Can I take my coverage with me? A. Yes, you can take your coverage with you.5 You will need to continue to pay your premiums to keep your coverage in force. Your coverage will only end if you stop paying your premium or if your employer offers you similar coverage with a different insurance carrier. Q. Who do I call for assistance? A. Contact a MetLife Customer Service Representative at 1 800- GET-MET8 (1-800-438-6388), Monday through Friday from 8:00 a.m. to 8:00 p.m., EST. Or visit our website: mybenefits.metlife.com. Covered Event3 Benefit Amount Ambulance (ground) $300 Emergency Care $100 Physician Follow-Up ($100 x 2) $200 Medical Testing $150 Concussion $250 Broken Tooth (repaired by crown) $200 Benefits paid by MetLife Group Accident Insurance $1,200

Accidentv2 Page 2 Page 4

Accidentv2 Page 2 Page 4