Accidentv2

This document outlines the benefits of an accident insurance plan from MetLife, detailing coverage for various injuries and medical services.

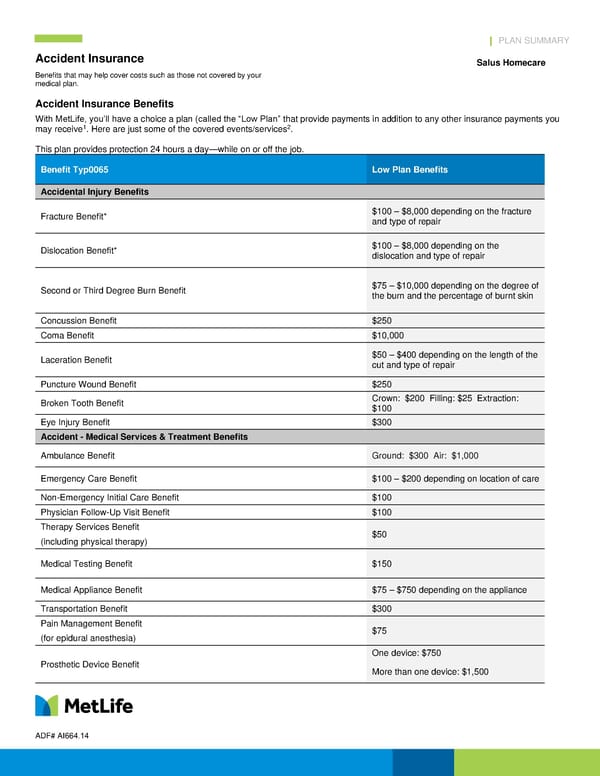

PLAN SUMMARY Accident Insurance Benefits that may help cover costs such as those not covered by your medical plan. Salus Homecare ADF# AI664.14 Accident Insurance Benefits With MetLife, you’ll have a choice a plan (called the “Low Plan” that provide payments in addition to any other insurance payments you may receive1. Here are just some of the covered events/services2. This plan provides protection 24 hours a day—while on or off the job. Benefit Typ0065 Low Plan Benefits Accidental Injury Benefits Fracture Benefit* $100 – $8,000 depending on the fracture and type of repair Dislocation Benefit* $100 – $8,000 depending on the dislocation and type of repair Second or Third Degree Burn Benefit $75 – $10,000 depending on the degree of the burn and the percentage of burnt skin Concussion Benefit $250 Coma Benefit $10,000 Laceration Benefit $50 – $400 depending on the length of the cut and type of repair Puncture Wound Benefit $250 Broken Tooth Benefit Crown: $200 Filling: $25 Extraction: $100 Eye Injury Benefit $300 Accident - Medical Services & Treatment Benefits Ambulance Benefit Ground: $300 Air: $1,000 Emergency Care Benefit $100 – $200 depending on location of care Non-Emergency Initial Care Benefit $100 Physician Follow-Up Visit Benefit $100 Therapy Services Benefit $50 (including physical therapy) Medical Testing Benefit $150 Medical Appliance Benefit $75 – $750 depending on the appliance Transportation Benefit $300 Pain Management Benefit $75 (for epidural anesthesia) Prosthetic Device Benefit One device: $750 More than one device: $1,500

Accidentv2 Page 2

Accidentv2 Page 2