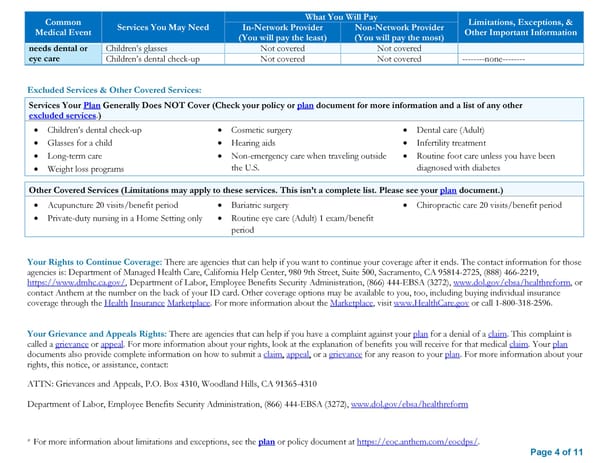

Common What You Will Pay Limitations, Exceptions, & Medical Event Services You May Need In-Network Provider Non-Network Provider Other Important Information (You will pay the least) (You will pay the most) needs dental or Children’s glasses Not covered Not covered eye care Children’s dental check-up Not covered Not covered --------none-------- Excluded Services & Other Covered Services: Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Children’s dental check-up Cosmetic surgery Dental care (Adult) Glasses for a child Hearing aids Infertility treatment Long-term care Non-emergency care when traveling outside Routine foot care unless you have been Weight loss programs the U.S. diagnosed with diabetes Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Acupuncture 20 visits/benefit period Bariatric surgery Chiropractic care 20 visits/benefit period Private-duty nursing in a Home Setting only Routine eye care (Adult) 1 exam/benefit period Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: Department of Managed Health Care, California Help Center, 980 9th Street, Suite 500, Sacramento, CA 95814-2725, (888) 466-2219, https://www.dmhc.ca.gov/, Department of Labor, Employee Benefits Security Administration, (866) 444-EBSA (3272), www.dol.gov/ebsa/healthreform, or contact Anthem at the number on the back of your ID card. Other coverage options may be available to you, too, including buying individual insurance coverage through the Health Insurance Marketplace. For more information about the Marketplace, visit www.HealthCare.gov or call 1-800-318-2596. Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called a grievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents also provide complete information on how to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance, contact: ATTN: Grievances and Appeals, P.O. Box 4310, Woodland Hills, CA 91365-4310 Department of Labor, Employee Benefits Security Administration, (866) 444-EBSA (3272), www.dol.gov/ebsa/healthreform * For more information about limitations and exceptions, see the plan or policy document at https://eoc.anthem.com/eocdps/. Page 4 of 11

Anthem Classic HMO 20/40/500 admit/250 OP SBC Page 3 Page 5

Anthem Classic HMO 20/40/500 admit/250 OP SBC Page 3 Page 5