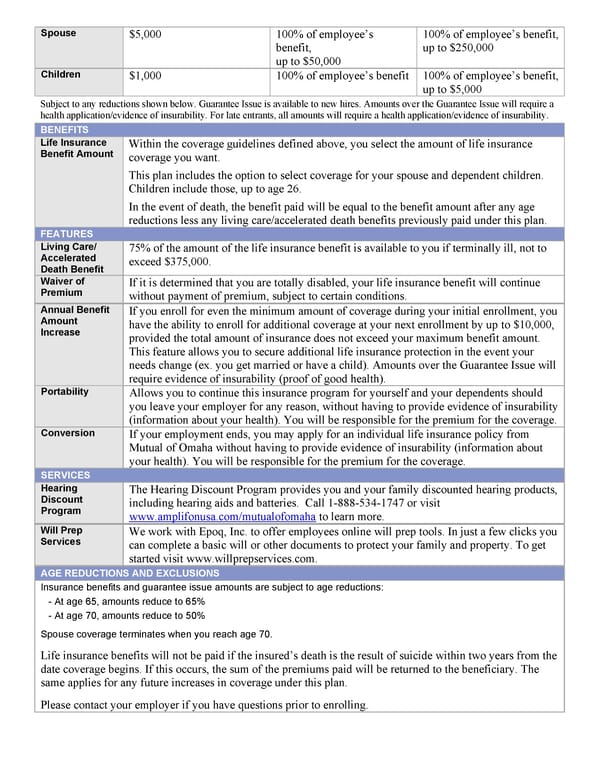

Spouse $5,000 100% of employee’s 100% of employee’s benefit, benefit, up to $250,000 up to $50,000 Children $1,000 100% of employee’s benefit 100% of employee’s benefit, up to $5,000 Subject to any reductions shown below. Guarantee Issue is available to new hires. Amounts over the Guarantee Issue will require a health application/evidence of insurability. For late entrants, all amounts will require a health application/evidence of insurability. BENEFITS Life Insurance Within the coverage guidelines defined above, you select the amount of life insurance Benefit Amount coverage you want. This plan includes the option to select coverage for your spouse and dependent children. Children include those, up to age 26. In the event of death, the benefit paid will be equal to the benefit amount after any age reductions less any living care/accelerated death benefits previously paid under this plan. FEATURES Living Care/ 75% of the amount of the life insurance benefit is available to you if terminally ill, not to Accelerated exceed $375,000. Death Benefit Waiver of If it is determined that you are totally disabled, your life insurance benefit will continue Premium without payment of premium, subject to certain conditions. Annual Benefit If you enroll for even the minimum amount of coverage during your initial enrollment, you Amount have the ability to enroll for additional coverage at your next enrollment by up to $10,000, Increase provided the total amount of insurance does not exceed your maximum benefit amount. This feature allows you to secure additional life insurance protection in the event your needs change (ex. you get married or have a child). Amounts over the Guarantee Issue will require evidence of insurability (proof of good health). Portability Allows you to continue this insurance program for yourself and your dependents should you leave your employer for any reason, without having to provide evidence of insurability (information about your health). You will be responsible for the premium for the coverage. Conversion If your employment ends, you may apply for an individual life insurance policy from Mutual of Omaha without having to provide evidence of insurability (information about your health). You will be responsible for the premium for the coverage. SERVICES Hearing The Hearing Discount Program provides you and your family discounted hearing products, Discount including hearing aids and batteries. Call 1-888-534-1747 or visit Program www.amplifonusa.com/mutualofomaha to learn more. Will Prep We work with Epoq, Inc. to offer employees online will prep tools. In just a few clicks you Services can complete a basic will or other documents to protect your family and property. To get started visit www.willprepservices.com. AGE REDUCTIONS AND EXCLUSIONS Insurance benefits and guarantee issue amounts are subject to age reductions: - At age 65, amounts reduce to 65% - At age 70, amounts reduce to 50% Spouse coverage terminates when you reach age 70. Life insurance benefits will not be paid if the insured’s death is the result of suicide within two years from the date coverage begins. If this occurs, the sum of the premiums paid will be returned to the beneficiary. The same applies for any future increases in coverage under this plan. Please contact your employer if you have questions prior to enrolling.

Blue Mantis VTL Summary Page 1 Page 3

Blue Mantis VTL Summary Page 1 Page 3