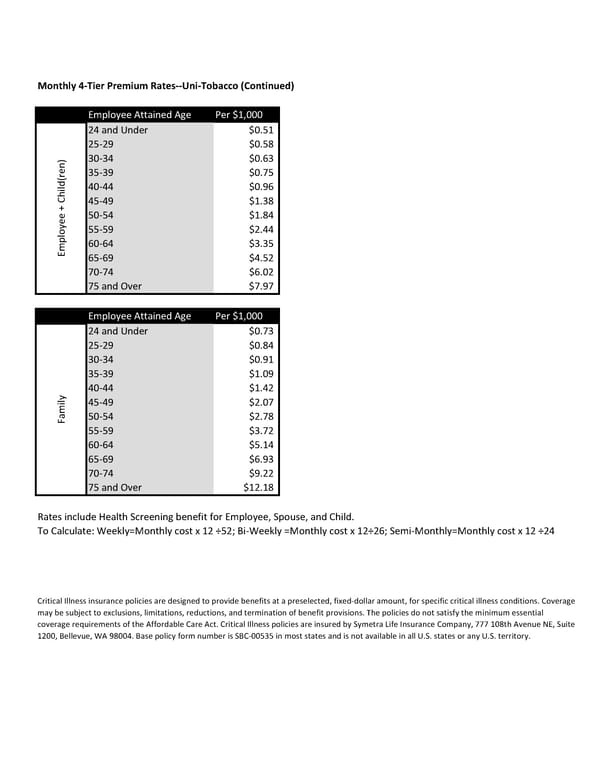

Monthly 4-Tier Premium Rates--Uni-Tobacco (Continued) Employee Attained Age Per $1,000 24 and Under $0.51 25-29 $0.58 ) 30-34 $0.63 (ren 35-39 $0.75 ild 40-44 $0.96 45-49 $1.38 50-54 $1.84 oyee + Ch55-59 $2.44 l 60-64 $3.35 Emp 65-69 $4.52 70-74 $6.02 75 and Over $7.97 Employee Attained Age Per $1,000 24 and Under $0.73 25-29 $0.84 30-34 $0.91 35-39 $1.09 40-44 $1.42 ily 45-49 $2.07 Fam 50-54 $2.78 55-59 $3.72 60-64 $5.14 65-69 $6.93 70-74 $9.22 75 and Over $12.18 Rates include Health Screening benefit for Employee, Spouse, and Child. To Calculate: Weekly=Monthly cost x 12 ÷52; Bi-Weekly =Monthly cost x 12÷26; Semi-Monthly=Monthly cost x 12 ÷24 Critical Illness insurance policies are designed to provide benefits at a preselected, fixed-dollar amount, for specific critical illness conditions. Coverage may be subject to exclusions, limitations, reductions, and termination of benefit provisions. The policies do not satisfy the minimum essential coverage requirements of the Affordable Care Act. Critical Illness policies are insured by Symetra Life Insurance Company, 777 108th Avenue NE, Suite 1200, Bellevue, WA 98004. Base policy form number is SBC-00535 in most states and is not available in all U.S. states or any U.S. territory.

Critical Illness Benefits Summary Page 10 Page 12

Critical Illness Benefits Summary Page 10 Page 12