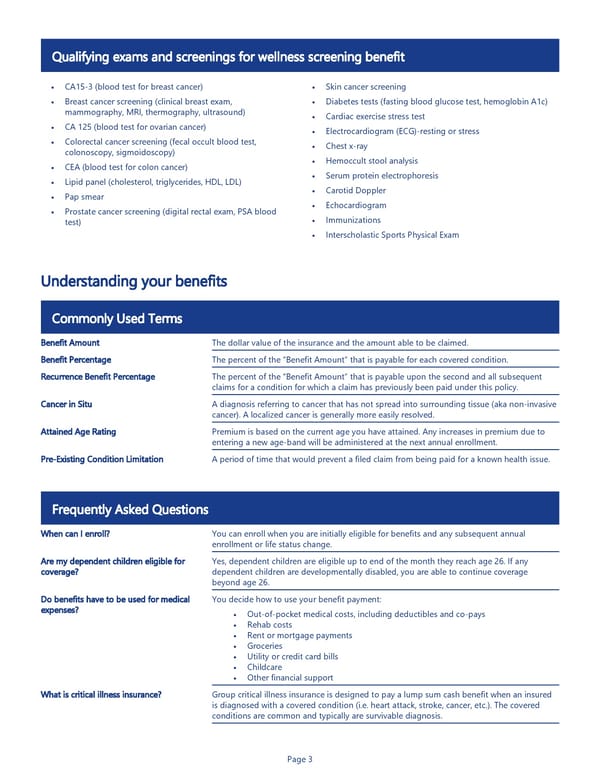

Page 3 • CA15-3 (blood test for breast cancer) • Breast cancer screening (clinical breast exam, mammography, MRI, thermography, ultrasound) • CA 125 (blood test for ovarian cancer) • Colorectal cancer screening (fecal occult blood test, colonoscopy, sigmoidoscopy) • CEA (blood test for colon cancer) • Lipid panel (cholesterol, triglycerides, HDL, LDL) • Pap smear • Prostate cancer screening (digital rectal exam, PSA blood test) Qualifying exams and screenings for wellness screening benefit • Skin cancer screening • Diabetes tests (fasting blood glucose test, hemoglobin A1c) • Cardiac exercise stress test • Electrocardiogram (ECG)-resting or stress • Chest x-ray • Hemoccult stool analysis • Serum protein electrophoresis • Carotid Doppler • Echocardiogram • Immunizations • Interscholastic Sports Physical Exam Understanding your benefits Commonly Used Terms Benefit Amount The dollar value of the insurance and the amount able to be claimed. Benefit Percentage The percent of the “Benefit Amount” that is payable for each covered condition. Recurrence Benefit Percentage The percent of the “Benefit Amount” that is payable upon the second and all subsequent claims for a condition for which a claim has previously been paid under this policy. Cancer in Situ A diagnosis referring to cancer that has not spread into surrounding tissue (aka non-invasive cancer). A localized cancer is generally more easily resolved. Attained Age Rating Premium is based on the current age you have attained. Any increases in premium due to entering a new age-band will be administered at the next annual enrollment. Pre-Existing Condition Limitation A period of time that would prevent a filed claim from being paid for a known health issue. Frequently Asked Questions When can I enroll? You can enroll when you are initially eligible for benefits and any subsequent annual enrollment or life status change. Are my dependent children eligible for coverage? Yes, dependent children are eligible up to end of the month they reach age 26. If any dependent children are developmentally disabled, you are able to continue coverage beyond age 26. Do benefits have to be used for medical expenses? You decide how to use your benefit payment: • Out-of-pocket medical costs, including deductibles and co-pays • Rehab costs • Rent or mortgage payments • Groceries • Utility or credit card bills • Childcare • Other financial support What is critical illness insurance? Group critical illness insurance is designed to pay a lump sum cash benefit when an insured is diagnosed with a covered condition (i.e. heart attack, stroke, cancer, etc.). The covered conditions are common and typically are survivable diagnosis. • • • • • • • • • • • • • • • • • • • • • • • • • •

Critical Illness Insurance Benefit Summary Page 2 Page 4

Critical Illness Insurance Benefit Summary Page 2 Page 4