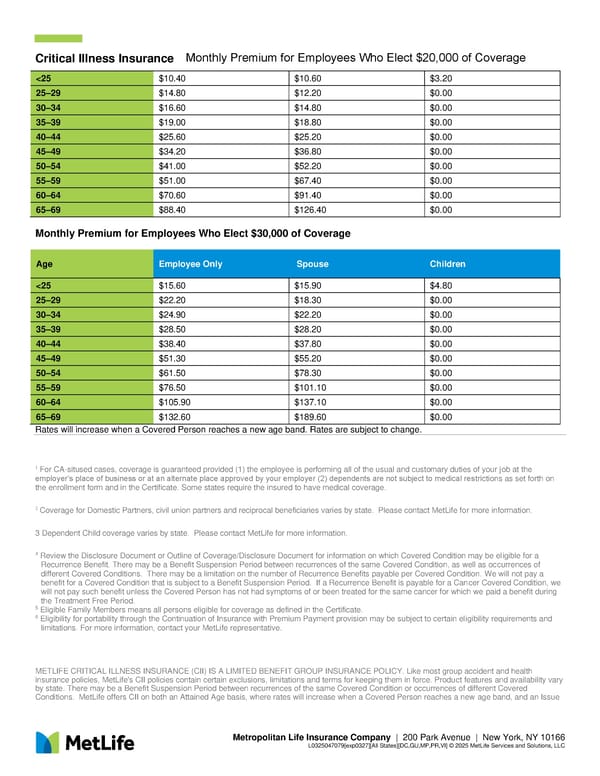

Critical Illness Insurance Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166 L0325047079[exp0327][All States][DC,GU,MP,PR,VI] © 2025 MetLife Services and Solutions, LLC Monthly Premium for Employees Who Elect $30,000 of Coverage Rates will increase when a Covered Person reaches a new age band. Rates are subject to change. 1 For CA-sitused cases, coverage is guaranteed provided (1) the employee is performing all of the usual and customary duties of your job at the employer’s place of business or at an alternate place approved by your employer (2) dependents are not subject to medical restrictions as set forth on the enrollment form and in the Certificate. Some states require the insured to have medical coverage. 2 Coverage for Domestic Partners, civil union partners and reciprocal beneficiaries varies by state. Please contact MetLife for more information. 3 Dependent Child coverage varies by state. Please contact MetLife for more information. 4 Review the Disclosure Document or Outline of Coverage/Disclosure Document for information on which Covered Condition may be eligible for a Recurrence Benefit. There may be a Benefit Suspension Period between recurrences of the same Covered Condition, as well as occurrences of different Covered Conditions. There may be a limitation on the number of Recurrence Benefits payable per Covered Condition. We will not pay a benefit for a Covered Condition that is subject to a Benefit Suspension Period. If a Recurrence Benefit is payable for a Cancer Covered Condition, we will not pay such benefit unless the Covered Person has not had symptoms of or been treated for the same cancer for which we paid a benefit during the Treatment Free Period. 5 Eligible Family Members means all persons eligible for coverage as defined in the Certificate. 6 Eligibility for portability through the Continuation of Insurance with Premium Payment provision may be subject to certain eligibility requirements and limitations. For more information, contact your MetLife representative. METLIFE CRITICAL ILLNESS INSURANCE (CII) IS A LIMITED BENEFIT GROUP INSURANCE POLICY. Like most group accident and health insurance policies, MetLife's CII policies contain certain exclusions, limitations and terms for keeping them in force. Product features and availability vary by state. There may be a Benefit Suspension Period between recurrences of the same Covered Condition or occurrences of different Covered Conditions. MetLife offers CII on both an Attained Age basis, where rates will increase when a Covered Person reaches a new age band, and an Issue

Critical Illnessv2 Page 4 Page 6

Critical Illnessv2 Page 4 Page 6