Dental Plan

This document outlines the Metropolitan Life Insurance Company's dental coverage plan for Salus Homecare, effective August 1, 2025, detailing in-network and out-of-network benefits, deductibles, and coverage types.

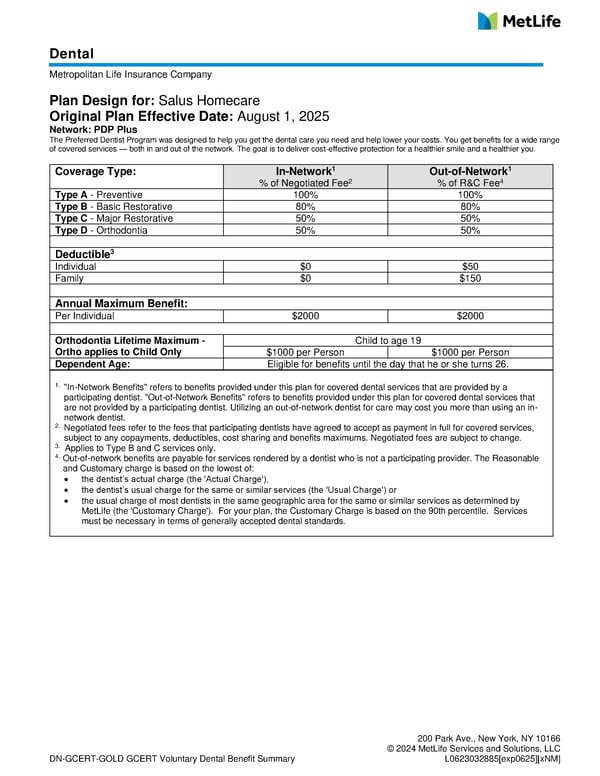

DN-GCERT-GOLD GCERT Voluntary Dental Benefit Summary 200 Park Ave., New York, NY 10166 © 2024 MetLife Services and Solutions, LLC L0623032885[exp0625][xNM] Dental Metropolitan Life Insurance Company Plan Design for: Salus Homecare Original Plan Effective Date: August 1, 2025 Network: PDP Plus The Preferred Dentist Program was designed to help you get the dental care you need and help lower your costs. You get benefits for a wide range of covered services — both in and out of the network. The goal is to deliver cost-effective protection for a healthier smile and a healthier you. Coverage Type: In-Network1 % of Negotiated Fee2 Out-of-Network1 % of R&C Fee4 Type A - Preventive 100% 100% Type B - Basic Restorative 80% 80% Type C - Major Restorative 50% 50% Type D - Orthodontia 50% 50% Deductible3 Individual $0 $50 Family $0 $150 Annual Maximum Benefit: Per Individual $2000 $2000 Orthodontia Lifetime Maximum - Ortho applies to Child Only Child to age 19 $1000 per Person $1000 per Person Dependent Age: Eligible for benefits until the day that he or she turns 26. 1. "In-Network Benefits" refers to benefits provided under this plan for covered dental services that are provided by a participating dentist. "Out-of-Network Benefits" refers to benefits provided under this plan for covered dental services that are not provided by a participating dentist. Utilizing an out-of-network dentist for care may cost you more than using an in- network dentist. 2. Negotiated fees refer to the fees that participating dentists have agreed to accept as payment in full for covered services, subject to any copayments, deductibles, cost sharing and benefits maximums. Negotiated fees are subject to change. 3. Applies to Type B and C services only. 4. Out-of-network benefits are payable for services rendered by a dentist who is not a participating provider. The Reasonable and Customary charge is based on the lowest of: • the dentist’s actual charge (the 'Actual Charge'), • the dentist’s usual charge for the same or similar services (the 'Usual Charge') or • the usual charge of most dentists in the same geographic area for the same or similar services as determined by MetLife (the 'Customary Charge'). For your plan, the Customary Charge is based on the 90th percentile. Services must be necessary in terms of generally accepted dental standards.

Dental Plan Page 2

Dental Plan Page 2