Group Critical Illness Plan Highlights

This document provides information on critical illness insurance coverage options and benefits offered by Meyers Nave, A Professional Corporation.

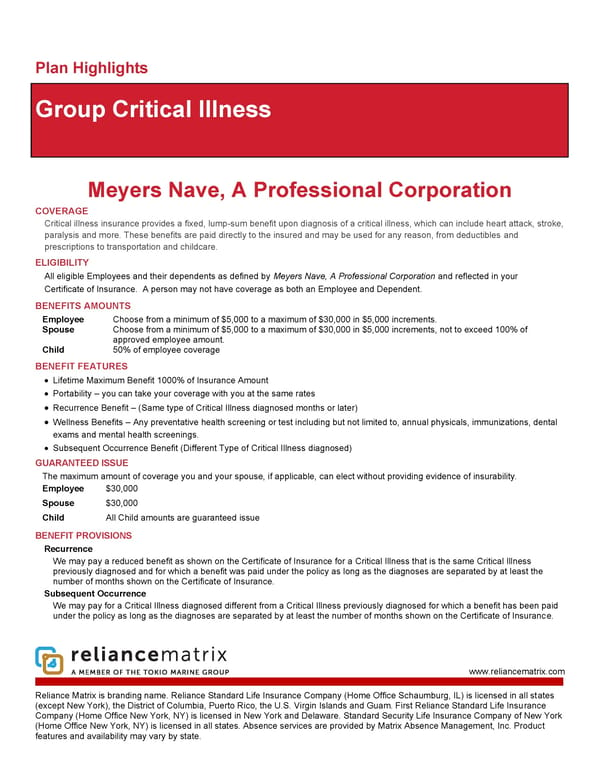

www.reliancematrix.com Reliance Matrix is branding name. Reliance Standard Life Insurance Company (Home Office Schaumburg, IL) is licensed in all states (except New York), the District of Columbia, Puerto Rico, the U.S. Virgin Islands and Guam. First Reliance Standard Life Insurance Company (Home Office New York, NY) is licensed in New York and Delaware. Standard Security Life Insurance Company of New York (Home Office New York, NY) is licensed in all states. Absence services are provided by Matrix Absence Management, Inc. Product features and availability may vary by state. Plan Highlights Group Critical Illness Meyers Nave, A Professional Corporation COVERAGE Critical illness insurance provides a fixed, lump-sum benefit upon diagnosis of a critical illness, which can include heart attack, stroke, paralysis and more. These benefits are paid directly to the insured and may be used for any reason, from deductibles and prescriptions to transportation and childcare. ELIGIBILITY All eligible Employees and their dependents as defined by Meyers Nave, A Professional Corporation and reflected in your Certificate of Insurance. A person may not have coverage as both an Employee and Dependent. BENEFITS AMOUNTS Employee Choose from a minimum of $5,000 to a maximum of $30,000 in $5,000 increments. Spouse Choose from a minimum of $5,000 to a maximum of $30,000 in $5,000 increments, not to exceed 100% of approved employee amount. Child 50% of employee coverage BENEFIT FEATURES • Lifetime Maximum Benefit 1000% of Insurance Amount • Portability – you can take your coverage with you at the same rates • Recurrence Benefit – (Same type of Critical Illness diagnosed months or later) • Wellness Benefits – Any preventative health screening or test including but not limited to, annual physicals, immunizations, dental exams and mental health screenings. • Subsequent Occurrence Benefit (Different Type of Critical Illness diagnosed) GUARANTEED ISSUE The maximum amount of coverage you and your spouse, if applicable, can elect without providing evidence of insurability. Employee $30,000 Spouse $30,000 Child All Child amounts are guaranteed issue BENEFIT PROVISIONS Recurrence We may pay a reduced benefit as shown on the Certificate of Insurance for a Critical Illness that is the same Critical Illness previously diagnosed and for which a benefit was paid under the policy as long as the diagnoses are separated by at least the number of months shown on the Certificate of Insurance. Subsequent Occurrence We may pay for a Critical Illness diagnosed different from a Critical Illness previously diagnosed for which a benefit has been paid under the policy as long as the diagnoses are separated by at least the number of months shown on the Certificate of Insurance.

Group Critical Illness Plan Highlights Page 2

Group Critical Illness Plan Highlights Page 2