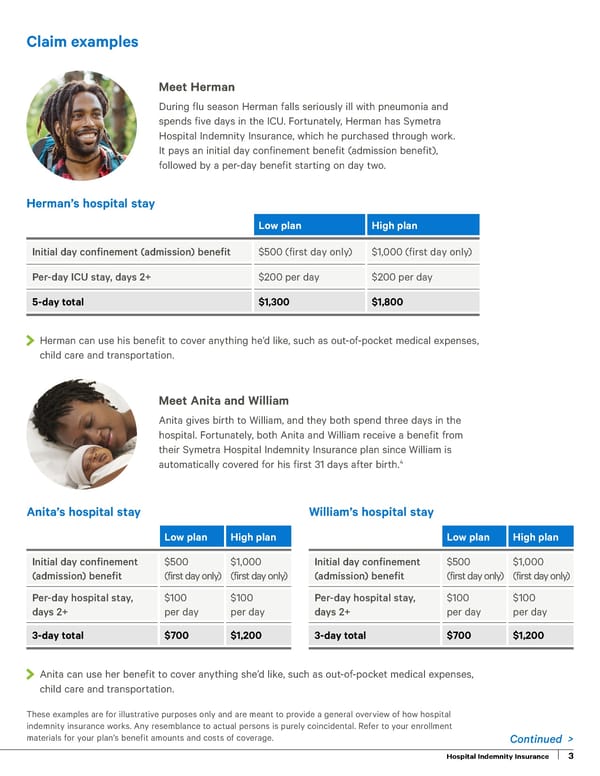

Claim examples Meet Herman During flu season Herman falls seriously ill with pneumonia and spends five days in the ICU. Fortunately, Herman has Symetra Hospital Indemnity Insurance, which he purchased through work. It pays an initial day confinement benefit (admission benefit), followed by a per-day benefit starting on day two. Herman’s hospital stay Low plan High plan Initial day confinement (admission) benefit $500 (first day only) $1,000 (first day only) Per-day ICU stay, days 2+ $200 per day $200 per day 5-day total $1,300 $1,800 Herman can use his benefit to cover anything he’d like, such as out-of-pocket medical expenses, child care and transportation. Meet Anita and William Anita gives birth to William, and they both spend three days in the hospital. Fortunately, both Anita and William receive a benefit from their Symetra Hospital Indemnity Insurance plan since William is automatically covered for his first 31 days after birth.4 Anita’s hospital stay William’s hospital stay Low plan High plan Low plan High plan Initial day confinement $500 $1,000 Initial day confinement $5�0 $1,000 (admission) benefit (first day only) (first day only) (admission) benefit (first day only) (first day only) Per-day hospital stay, $100 $100 Per-day hospital stay, $100 $100 days 2+ per day per day days 2+ per day per day 3-day total $700 $1,200 3-day total $700 $1,200 Anita can use her benefit to cover anything she’d like, such as out-of-pocket medical expenses, child care and transportation. These examples are for illustrative purposes only and are meant to provide a general overview of how hospital indemnity insurance works. Any resemblance to actual persons is purely coincidental. Refer to your enrollment materials for your plan’s benefit amounts and costs of coverage. Continued > 2Hospital Indemnity Insurance Hospital Indemnity Insurance 3

Hospital Indemnity Page 2 Page 4

Hospital Indemnity Page 2 Page 4