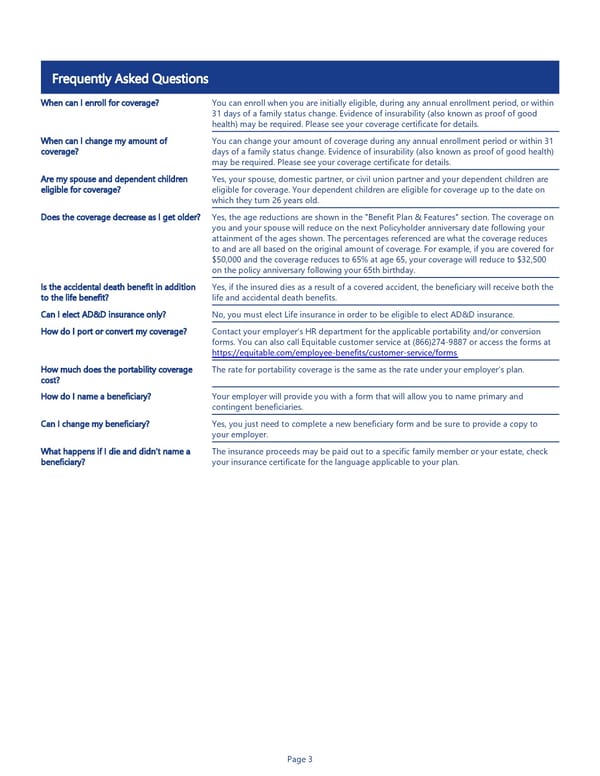

Page 3 Frequently Asked Questions When can I enroll for coverage? You can enroll when you are initially eligible, during any annual enrollment period, or within 31 days of a family status change. Evidence of insurability (also known as proof of good health) may be required. Please see your coverage certificate for details. When can I change my amount of coverage? You can change your amount of coverage during any annual enrollment period or within 31 days of a family status change. Evidence of insurability (also known as proof of good health) may be required. Please see your coverage certificate for details. Are my spouse and dependent children eligible for coverage? Yes, your spouse, domestic partner, or civil union partner and your dependent children are eligible for coverage. Your dependent children are eligible for coverage up to the date on which they turn 26 years old. Does the coverage decrease as I get older? Yes, the age reductions are shown in the "Benefit Plan & Features" section. The coverage on you and your spouse will reduce on the next Policyholder anniversary date following your attainment of the ages shown. The percentages referenced are what the coverage reduces to and are all based on the original amount of coverage. For example, if you are covered for $50,000 and the coverage reduces to 65% at age 65, your coverage will reduce to $32,500 on the policy anniversary following your 65th birthday. Is the accidental death benefit in addition to the life benefit? Yes, if the insured dies as a result of a covered accident, the beneficiary will receive both the life and accidental death benefits. Can I elect AD&D insurance only? No, you must elect Life insurance in order to be eligible to elect AD&D insurance. How do I port or convert my coverage? Contact your employer’s HR department for the applicable portability and/or conversion forms. You can also call Equitable customer service at (866)274-9887 or access the forms at https://equitable.com/employee-benefits/customer-service/forms How much does the portability coverage cost? The rate for portability coverage is the same as the rate under your employer’s plan. How do I name a beneficiary? Your employer will provide you with a form that will allow you to name primary and contingent beneficiaries. Can I change my beneficiary? Yes, you just need to complete a new beneficiary form and be sure to provide a copy to your employer. What happens if I die and didn’t name a beneficiary? The insurance proceeds may be paid out to a specific family member or your estate, check your insurance certificate for the language applicable to your plan.

Life Insurance Benefit Summary Page 2 Page 4

Life Insurance Benefit Summary Page 2 Page 4