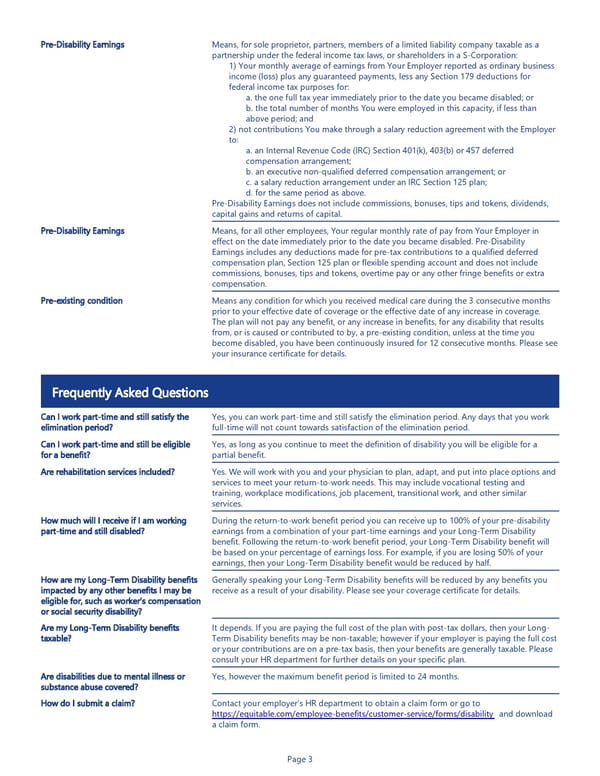

Page 3 Pre-Disability Earnings Means, for sole proprietor, partners, members of a limited liability company taxable as a partnership under the federal income tax laws, or shareholders in a S-Corporation: 1) Your monthly average of earnings from Your Employer reported as ordinary business income (loss) plus any guaranteed payments, less any Section 179 deductions for federal income tax purposes for: a. the one full tax year immediately prior to the date you became disabled; or b. the total number of months You were employed in this capacity, if less than above period; and 2) not contributions You make through a salary reduction agreement with the Employer to: a. an Internal Revenue Code (IRC) Section 401(k), 403(b) or 457 deferred compensation arrangement; b. an executive non-qualified deferred compensation arrangement; or c. a salary reduction arrangement under an IRC Section 125 plan; d. for the same period as above. Pre-Disability Earnings does not include commissions, bonuses, tips and tokens, dividends, capital gains and returns of capital. Pre-Disability Earnings Means, for all other employees, Your regular monthly rate of pay from Your Employer in effect on the date immediately prior to the date you became disabled. Pre-Disability Earnings includes any deductions made for pre-tax contributions to a qualified deferred compensation plan, Section 125 plan or flexible spending account and does not include commissions, bonuses, tips and tokens, overtime pay or any other fringe benefits or extra compensation. Pre-existing condition Means any condition for which you received medical care during the 3 consecutive months prior to your effective date of coverage or the effective date of any increase in coverage. The plan will not pay any benefit, or any increase in benefits, for any disability that results from, or is caused or contributed to by, a pre-existing condition, unless at the time you become disabled, you have been continuously insured for 12 consecutive months. Please see your insurance certificate for details. Frequently Asked Questions Can I work part-time and still satisfy the elimination period? Yes, you can work part-time and still satisfy the elimination period. Any days that you work full-time will not count towards satisfaction of the elimination period. Can I work part-time and still be eligible for a benefit? Yes, as long as you continue to meet the definition of disability you will be eligible for a partial benefit. Are rehabilitation services included? Yes. We will work with you and your physician to plan, adapt, and put into place options and services to meet your return-to-work needs. This may include vocational testing and training, workplace modifications, job placement, transitional work, and other similar services. How much will I receive if I am working part-time and still disabled? During the return-to-work benefit period you can receive up to 100% of your pre-disability earnings from a combination of your part-time earnings and your Long-Term Disability benefit. Following the return-to-work benefit period, your Long-Term Disability benefit will be based on your percentage of earnings loss. For example, if you are losing 50% of your earnings, then your Long-Term Disability benefit would be reduced by half. How are my Long-Term Disability benefits impacted by any other benefits I may be eligible for, such as worker’s compensation or social security disability? Generally speaking your Long-Term Disability benefits will be reduced by any benefits you receive as a result of your disability. Please see your coverage certificate for details. Are my Long-Term Disability benefits taxable? It depends. If you are paying the full cost of the plan with post-tax dollars, then your Long- Term Disability benefits may be non-taxable; however if your employer is paying the full cost or your contributions are on a pre-tax basis, then your benefits are generally taxable. Please consult your HR department for further details on your specific plan. Are disabilities due to mental illness or substance abuse covered? Yes, however the maximum benefit period is limited to 24 months. How do I submit a claim? Contact your employer’s HR department to obtain a claim form or go to https://equitable.com/employee-benefits/customer-service/forms/disability and download a claim form.

Long-Term Disability Insurance Benefit Summary Page 2 Page 4

Long-Term Disability Insurance Benefit Summary Page 2 Page 4