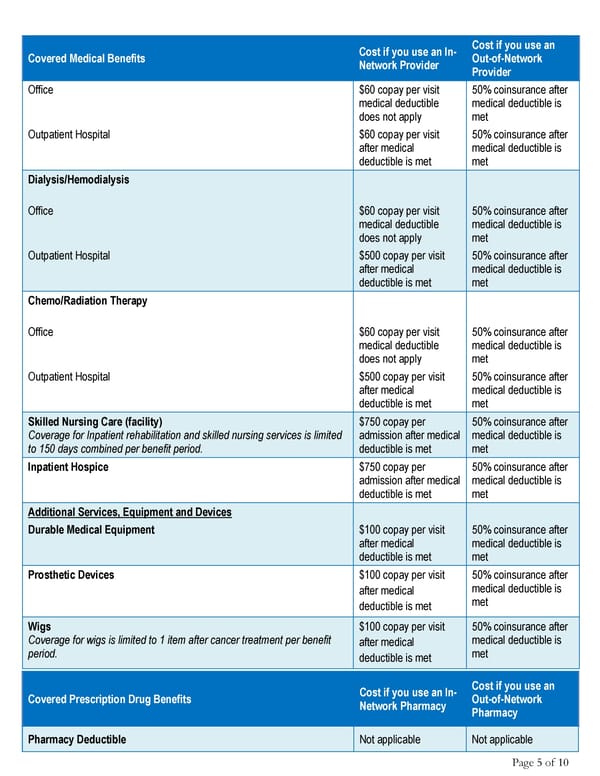

Page 5 of 10 Covered Medical Benefits Cost if you use an In- Network Provider Cost if you use an Out-of-Network Provider Office $60 copay per visit medical deductible does not apply 50% coinsurance after medical deductible is met Outpatient Hospital $60 copay per visit after medical deductible is met 50% coinsurance after medical deductible is met Dialysis/Hemodialysis Office $60 copay per visit medical deductible does not apply 50% coinsurance after medical deductible is met Outpatient Hospital $500 copay per visit after medical deductible is met 50% coinsurance after medical deductible is met Chemo/Radiation Therapy Office $60 copay per visit medical deductible does not apply 50% coinsurance after medical deductible is met Outpatient Hospital $500 copay per visit after medical deductible is met 50% coinsurance after medical deductible is met Skilled Nursing Care (facility) Coverage for Inpatient rehabilitation and skilled nursing services is limited to 150 days combined per benefit period. $750 copay per admission after medical deductible is met 50% coinsurance after medical deductible is met Inpatient Hospice $750 copay per admission after medical deductible is met 50% coinsurance after medical deductible is met Additional Services, Equipment and Devices Durable Medical Equipment $100 copay per visit after medical deductible is met 50% coinsurance after medical deductible is met Prosthetic Devices $100 copay per visit after medical deductible is met 50% coinsurance after medical deductible is met Wigs Coverage for wigs is limited to 1 item after cancer treatment per benefit period. $100 copay per visit after medical deductible is met 50% coinsurance after medical deductible is met Covered Prescription Drug Benefits Cost if you use an In- Network Pharmacy Cost if you use an Out-of-Network Pharmacy Pharmacy Deductible Not applicable Not applicable

Anthem Blue Cross: Summary of Benefits Page 4 Page 6

Anthem Blue Cross: Summary of Benefits Page 4 Page 6