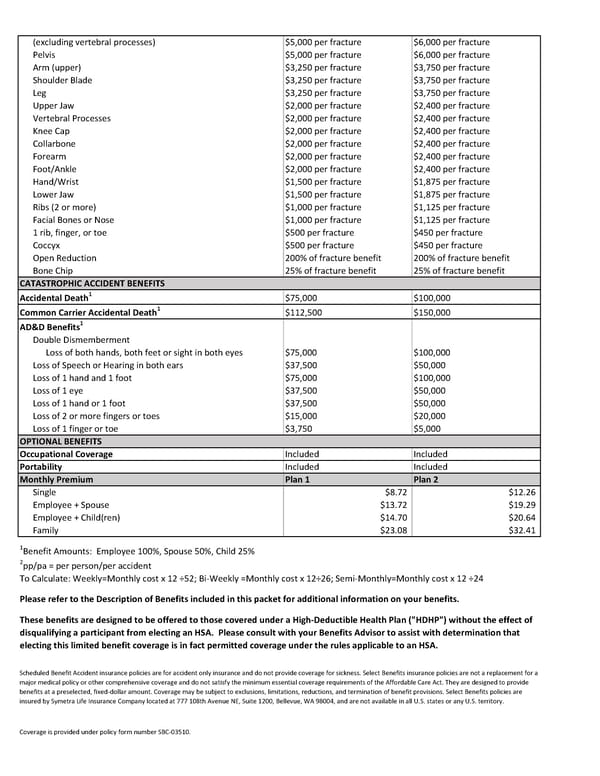

(excluding vertebral processes) $5,000 per fracture $6,000 per fracture Pelvis $5,000 per fracture $6,000 per fracture Arm (upper) $3,250 per fracture $3,750 per fracture Shoulder Blade $3,250 per fracture $3,750 per fracture Leg $3,250 per fracture $3,750 per fracture Upper Jaw $2,000 per fracture $2,400 per fracture Vertebral Processes $2,000 per fracture $2,400 per fracture Knee Cap $2,000 per fracture $2,400 per fracture Collarbone $2,000 per fracture $2,400 per fracture Forearm $2,000 per fracture $2,400 per fracture Foot/Ankle $2,000 per fracture $2,400 per fracture Hand/Wrist $1,500 per fracture $1,875 per fracture Lower Jaw $1,500 per fracture $1,875 per fracture Ribs (2 or more) $1,000 per fracture $1,125 per fracture Facial Bones or Nose $1,000 per fracture $1,125 per fracture 1 rib, finger, or toe $500 per fracture $450 per fracture Coccyx $500 per fracture $450 per fracture Open Reduction 200% of fracture benefit 200% of fracture benefit Bone Chip 25% of fracture benefit 25% of fracture benefit CATASTROPHIC ACCIDENT BENEFITS Accidental Death1 $75,000 $100,000 Common Carrier Accidental Death1 $112,500 $150,000 1 AD&D Benefits Double Dismemberment Loss of both hands, both feet or sight in both eyes $75,000 $100,000 Loss of Speech or Hearing in both ears $37,500 $50,000 Loss of 1 hand and 1 foot $75,000 $100,000 Loss of 1 eye $37,500 $50,000 Loss of 1 hand or 1 foot $37,500 $50,000 Loss of 2 or more fingers or toes $15,000 $20,000 Loss of 1 finger or toe $3,750 $5,000 OPTIONAL BENEFITS Occupational Coverage Included Included Portability Included Included Monthly Premium Plan 1 Plan 2 Single $8.72 $12.26 Employee + Spouse $13.72 $19.29 Employee + Child(ren) $14.70 $20.64 Family $23.08 $32.41 1Benefit Amounts: Employee 100%, Spouse 50%, Child 25% 2pp/pa = per person/per accident To Calculate: Weekly=Monthly cost x 12 ÷52; Bi-Weekly =Monthly cost x 12÷26; Semi-Monthly=Monthly cost x 12 ÷24 Please refer to the Description of Benefits included in this packet for additional information on your benefits. These benefits are designed to be offered to those covered under a High-Deductible Health Plan ("HDHP") without the effect of disqualifying a participant from electing an HSA. Please consult with your Benefits Advisor to assist with determination that electing this limited benefit coverage is in fact permitted coverage under the rules applicable to an HSA. Scheduled Benefit Accident insurance policies are for accident only insurance and do not provide coverage for sickness. Select Benefits insurance policies are not a replacement for a major medical policy or other comprehensive coverage and do not satisfy the minimum essential coverage requirements of the Affordable Care Act. They are designed to provide benefits at a preselected, fixed-dollar amount. Coverage may be subject to exclusions, limitations, reductions, and termination of benefit provisions. Select Benefits policies are insured by Symetra Life Insurance Company located at 777 108th Avenue NE, Suite 1200, Bellevue, WA 98004, and are not available in all U.S. states or any U.S. territory. Coverage is provided under policy form number SBC-03510.

Accident Benefits Summary Page 2 Page 4

Accident Benefits Summary Page 2 Page 4