Achieva Benefit Guide 2025

2025 Benefits Guide YOUR BENEFITS JOURNEY

S TARTS H E RE Y O U R J O U R N E Y T O H O W T O U S E T H I S G U I D E When you see the icons below, click to link out to websites, download documents, or learn more! ? Carrier Logos Learn More ENROLLMENT

EMPOWERING PEOPLE WITH DISABILITIES Achieva was founded in 1951 by a group of family members who all desired the same thing - to ensure their children with disabilities had the same chances in life that all children should be given. Their commitment helped to establish a nationwide movement that changed the long history of isolation and segregation for both children and adults with disabilities. Achieva is the only agency of its type in southwestern Pennsylvania that provides lifelong supports. From early intervention therapy and diverse living options to employment services and special needs trusts, Achieva provides through the entire life-span. Achieva is a nonprofit parent organization that has comprehensive services and supports and serves thousands of people with disabilities and their families each year.

CONTINUED ON THE NEXT PAGE KNOW YOUR BENEFITS • Coinsurance—The amount or percentage that you pay for certain covered health care services under your health plan. This is typically the amount paid after a deductible is met, and can vary based on the plan design. • Covered Expenses—Health care expenses that are covered under your health plan. • Deductible—A specific dollar amount you pay out of pocket before benefits are available through a health plan. Under some plans, the deductible is waived for certain services. • Dependent—spouses and children who meet eligibility requirements under a health plan and are enrolled in the plan as a dependent. Spouses are eligible for Achieva’s healthcare plan if they do not have access to healthcare through their employer. • Exclusive Provider Organization (EPO)—A health plan that offers in-network benefits only. Members must choose one of the in-network providers or facilities to receive benefits (except in emergency situations). • Flexible Spending Account (FSA)—An account that allows you to save tax-free dollars for qualified medical and/or dependent care expenses that are not reimbursed. You determine how much you want to contribute to the FSA at the beginning of the plan year. There is no rollover or grace period for Achieva’s 7/1/2024 FSA plans. • Inpatient—A person who is treated as a registered patient in a hospital or other health care facility. Open Enrollment Glossary of Terms Open enrollment is the time of year reserved for you to make changes to your benefit elections, and unfamiliar terms can make this process confusing. Use these definitions of common open enrollment terms to help you navigate your benefits options.

KNOW YOUR BENEFITS • Medically Necessary (or medical necessity)—Services or supplies provided by a hospital, health care facility or physician that meet the following criteria: (1) are appropriate for the symptoms and diagnosis and/or treatment of the condition, illness, disease or injury; (2) serve to provide diagnosis or direct care and/or treatment of the condition, illness, disease or injury; (3) are in accordance with standards of good medical practice; (4) are not primarily serving as convenience; and (5) are considered the most appropriate care available. • Medicare—An insurance program administered by the federal government to provide health coverage to individuals aged 65 and older, or who have certain disabilities or illnesses. • Out-of-pocket Expense—Amount that you must pay toward the cost of health care services. This includes deductibles, copayments and coinsurance. • Out-of-pocket Maximum (OOPM)—The highest out-of-pocket amount paid for covered services during a benefit period. • Premium—The amount you pay for a health plan in exchange for coverage. • Preventive Care—Routine health care, including screenings, check-ups, and patient counseling, to prevent or discover illness, disease, or other health problems. Covered 100% In Network and not subject to deductible. • Primary Care Physician (PCP)—A doctor that is selected to coordinate treatment under your health plan. This generally includes family practice physicians, general practitioners, internists, pediatricians, etc. Open Enrollment Glossary of Terms (Continued)

ENROLL HERE ENROLLMENT & ELIGIBILITY Eligibility Regular status full-time employees and your eligible dependents are eligible for the Achieva medical*, flexible spending, dental and vision benefits. All employees can participate in the Employee Assistance Program and access wellness tools and applications. *Working spouse exclusion applies. Mid-Year Changes Once your enrollment window closes, the only time you are allowed to make changes to your benefits elections in the middle of the year is if you experience a qualifying life event. Examples may include getting married or divorced, having a baby or adopting, or gaining or losing coverage. You must notify Human Resources within 30 days of the qualifying life event to be eligible to change your elections. Enrollment To complete your open enrollment elections, login to Paycom Employee Self Service (ESS), navigate to the Benefits section and choose 2025 Benefits Enrollment. Your Human Resource Contact: hrsupport@achieva.info 412-995-5000 x650

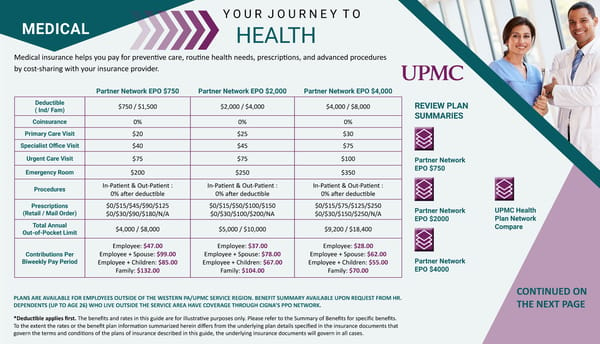

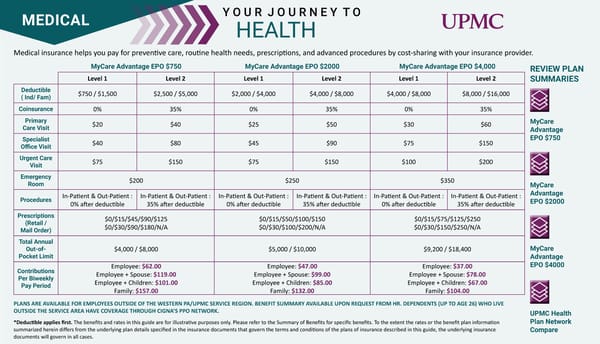

CHANGES TO MEDICAL BENEFITS FOR 2025 Achieva currently offers two MyCare Advantage EPO plans. Effective July 1, 2025, Achieva will offer six plans through UPMC - three Partner Network EPO plans and three MyCare Advantage EPO plans. Please review the next two pages thoroughly before making a selection. They contain a summary of the benefits and the bi-weekly contributions for each plan. Also, each page has a UPMC Health Plan Network compare document. You can review this by clicking on the purple icon above the name of the document.

CONTINUED ON THE NEXT PAGE MEDICAL Y O U R J O U R N E Y T O HEALTH REVIEW PLAN SUMMARIES Partner Network EPO $750 Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Partner Network EPO $750 Partner Network EPO $2,000 Partner Network EPO $4,000 Deductible ( Ind/ Fam) $750 / $1,500 $2,000 / $4,000 $4,000 / $8,000 Coinsurance 0% 0% 0% Primary Care Visit $20 $25 $30 Specialist Office Visit $40 $45 $75 Urgent Care Visit $75 $75 $100 Emergency Room $200 $250 $350 Procedures In-Patient & Out-Patient : 0% after deductible In-Patient & Out-Patient : 0% after deductible In-Patient & Out-Patient : 0% after deductible Prescriptions (Retail / Mail Order) $0/$15/$45/$90/$125 $0/$30/$90/$180/N/A $0/$15/$50/$100/$150 $0/$30/$100/$200/NA $0/$15/$75/$125/$250 $0/$30/$150/$250/N/A Total Annual Out-of-Pocket Limit $4,000 / $8,000 $5,000 / $10,000 $9,200 / $18,400 Contributions Per Biweekly Pay Period Employee: $47.00 Employee + Spouse: $99.00 Employee + Children: $85.00 Family: $132.00 Employee: $37.00 Employee + Spouse: $78.00 Employee + Children: $67.00 Family: $104.00 Employee: $28.00 Employee + Spouse: $62.00 Employee + Children: $55.00 Family: $70.00 Partner Network EPO $2000 UPMC Health Plan Network Compare Partner Network EPO $4000 PLANS ARE AVAILABLE FOR EMPLOYEES OUTSIDE OF THE WESTERN PA/UPMC SERVICE REGION. BENEFIT SUMMARY AVAILABLE UPON REQUEST FROM HR. DEPENDENTS (UP TO AGE 26) WHO LIVE OUTSIDE THE SERVICE AREA HAVE COVERAGE THROUGH CIGNA’S PPO NETWORK. *Deductible applies first. The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

MEDICAL Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Y O U R J O U R N E Y T O HEALTH MyCare Advantage EPO $750 MyCare Advantage EPO $2000 MyCare Advantage EPO $4,000 Level 1 Level 2 Level 1 Level 2 Level 1 Level 2 Deductible ( Ind/ Fam) $750 / $1,500 $2,500 / $5,000 $2,000 / $4,000 $4,000 / $8,000 $4,000 / $8,000 $8,000 / $16,000 Coinsurance 0% 35% 0% 35% 0% 35% Primary Care Visit $20 $40 $25 $50 $30 $60 Specialist Office Visit $40 $80 $45 $90 $75 $150 Urgent Care Visit $75 $150 $75 $150 $100 $200 Emergency Room $200 $250 $350 Procedures In-Patient & Out-Patient : 0% after deductible In-Patient & Out-Patient : 35% after deductible In-Patient & Out-Patient : 0% after deductible In-Patient & Out-Patient : 35% after deductible In-Patient & Out-Patient : 0% after deductible In-Patient & Out-Patient : 35% after deductible Prescriptions (Retail / Mail Order) $0/$15/$45/$90/$125 $0/$30/$90/$180/N/A $0/$15/$50/$100/$150 $0/$30/$100/$200/N/A $0/$15/$75/$125/$250 $0/$30/$150/$250/N/A Total Annual Out-of- Pocket Limit $4,000 / $8,000 $5,000 / $10,000 $9,200 / $18,400 Contributions Per Biweekly Pay Period Employee: $62.00 Employee + Spouse: $119.00 Employee + Children: $101.00 Family: $157.00 Employee: $47.00 Employee + Spouse: $99.00 Employee + Children: $85.00 Family: $132.00 Employee: $37.00 Employee + Spouse: $78.00 Employee + Children: $67.00 Family: $104.00 PLANS ARE AVAILABLE FOR EMPLOYEES OUTSIDE OF THE WESTERN PA/UPMC SERVICE REGION. BENEFIT SUMMARY AVAILABLE UPON REQUEST FROM HR. DEPENDENTS (UP TO AGE 26) WHO LIVE OUTSIDE THE SERVICE AREA HAVE COVERAGE THROUGH CIGNA’S PPO NETWORK. *Deductible applies first. The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. REVIEW PLAN SUMMARIES MyCare Advantage EPO $750 MyCare Advantage EPO $2000 MyCare Advantage EPO $4000 UPMC Health Plan Network Compare

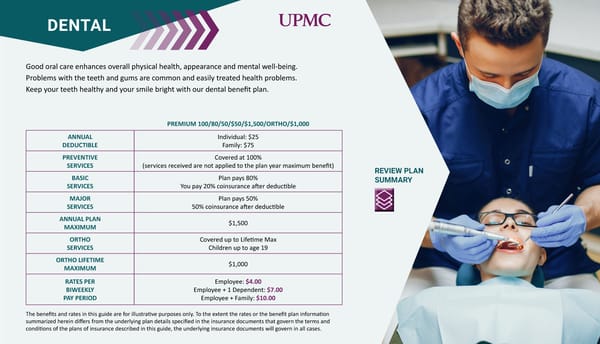

DENTAL Good oral care enhances overall physical health, appearance and mental well-being. Problems with the teeth and gums are common and easily treated health problems. Keep your teeth healthy and your smile bright with our dental benefit plan. PREMIUM 100/80/50/$50/$1,500/ORTHO/$1,000 ANNUAL DEDUCTIBLE Individual: $25 Family: $75 PREVENTIVE SERVICES Covered at 100% (services received are not applied to the plan year maximum benefit) BASIC SERVICES Plan pays 80% You pay 20% coinsurance after deductible MAJOR SERVICES Plan pays 50% 50% coinsurance after deductible ANNUAL PLAN MAXIMUM $1,500 ORTHO SERVICES Covered up to Lifetime Max Children up to age 19 ORTHO LIFETIME MAXIMUM $1,000 RATES PER BIWEEKLY PAY PERIOD Employee: $4.00 Employee + 1 Dependent: $7.00 Employee + Family: $10.00 The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. REVIEW PLAN SUMMARY

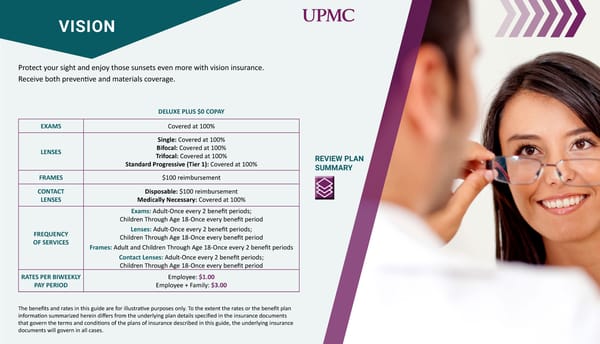

VISION Protect your sight and enjoy those sunsets even more with vision insurance. Receive both preventive and materials coverage. DELUXE PLUS $0 COPAY EXAMS Covered at 100% LENSES Single: Covered at 100% Bifocal: Covered at 100% Trifocal: Covered at 100% Standard Progressive (Tier 1): Covered at 100% FRAMES $100 reimbursement CONTACT LENSES Disposable: $100 reimbursement Medically Necessary: Covered at 100% FREQUENCY OF SERVICES Exams: Adult-Once every 2 benefit periods; Children Through Age 18-Once every benefit period Lenses: Adult-Once every 2 benefit periods; Children Through Age 18-Once every benefit period Frames: Adult and Children Through Age 18-Once every 2 benefit periods Contact Lenses: Adult-Once every 2 benefit periods; Children Through Age 18-Once every benefit period RATES PER BIWEEKLY PAY PERIOD Employee: $1.00 Employee + Family: $3.00 The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. REVIEW PLAN SUMMARY

Take a Healthy Step is an annual health and wellness campaign that provides an opportunity for members to complete “healthy steps” — activities and services designed to improve and maintain healthy lifestyle. You can earn a $375 deductible discount for individual coverage or a $750 deductible discount for family coverage for the 7/1/2026 – 6/30/2027 plan year by completing activities that are recommended for you. These activities are designed to help you understand and improve your health. Do it for yourself, do it for your family, and do it one step at a time. TAKE A HEALTHY STEP TAKE A HEALTHY STEP PLAN OVERVIEW

ADDITIONAL BENEFITS We offer these additional benefit options to help you and your family navigate life’s demands. Click the icons below to learn more about each of these benefits. RXWELL HEALTH COACHING ACTIVE & FIT DIRECT DIGITAL TOOLS

UPMC ANYWHERECARE Your life is an adventure, and Telemedicine affords you the convenience of receiving medical care while on the go. Instead of spending your day and dollars at an Urgent Care facility, connect with a board-certified doctor over the phone or video chat to receive immediate and cost-effective care wherever life’s journey may take you. Virtual Urgent Care and Children’s AnywhereCare is covered at 100%; you pay $0 for both plans. Benefits 101 Telemedicine Check your plan summary for costs

EMPLOYEE ASSISTANCE PROGRAM (EAP) You encounter more than just health concerns throughout your life. Manage life’s curveballs with a confidential and complimentary program designed to provide counseling, support, and resources for a variety of personal issues like stress and anxiety, relationship struggles, substance abuse, eldercare, financial worries and much more. Get the support you need today: WELLBEING If you think your physical health alone is related to your overall performance, think again. Total Wellbeing as a whole is comprised of 5 elements: physical, financial, communal, emotional, and purpose. To build your overall wellbeing, you have to make sure all of these elements are being “exercised”. Scroll over each of the icons below to learn more about wellbeing.

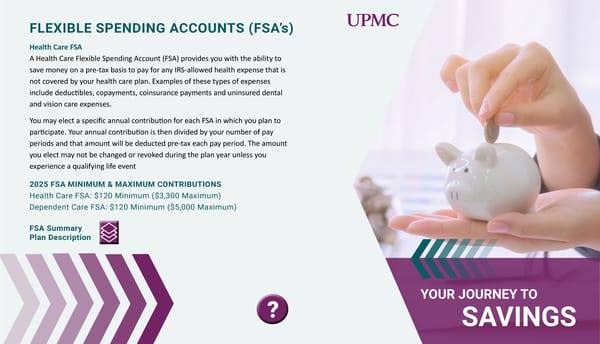

FLEXIBLE SPENDING ACCOUNTS (FSA’s) Health Care FSA A Health Care Flexible Spending Account (FSA) provides you with the ability to save money on a pre-tax basis to pay for any IRS-allowed health expense that is not covered by your health care plan. Examples of these types of expenses include deductibles, copayments, coinsurance payments and uninsured dental and vision care expenses. You may elect a specific annual contribution for each FSA in which you plan to participate. Your annual contribution is then divided by your number of pay periods and that amount will be deducted pre-tax each pay period. The amount you elect may not be changed or revoked during the plan year unless you experience a qualifying life event 2025 FSA MINIMUM & MAXIMUM CONTRIBUTIONS Health Care FSA: $120 Minimum ($3,300 Maximum) Dependent Care FSA: $120 Minimum ($5,000 Maximum) YOUR JOURNEY TO SAVINGS ? FSA Summary Plan Description

LIFE INSURANCE You can't put a price tag on your life, but you can protect your loved ones with life insurance in the event of a premature loss. BASIC LIFE AND AD&D - You are automatically enrolled in this employer-paid coverage. AVAILABLE COVERAGE 2x your earnings to a maximum of $300,000 BENEFIT REDUCTIONS AGE 65 70 75 80 REDUCTION 35% 60% 75% 85% VOLUNTARY LIFE AND AD&D - You must elect this employee-paid coverage through Paycom. If you did not enroll when you were first eligible, any election will require a personal health application. EMPLOYEE Increments of $10,000 up to 5x your earnings; $500,000 Maximum SPOUSE Increments of $5,000 up to 100% of Employee Amount up to $250,000 CHILD Increments of $1,000, maximum benefit of $5,000 TERM LIFE INSURANCE 101 REVIEW PLAN SUMMARY BASIC LIFE REVIEW PLAN SUMMARY VOLUNTARY LIFE

DISABILITY Accidents and illnesses happen and often when we least expect them. Ensure you are financially prepared to stay afloat during a medical condition with disability insurance. SHORT-TERM DISABILITY 101 LONG-TERM DISABILITY 101 VOLUNTARY SHORT-TERM DISABILITY You must elect this employee-paid coverage through Paycom. If you did not enroll when you were first eligible, any election will require a personal health application. BENEFIT 60% of your earnings to a maximum of $2,500 a week DURATION 11 weeks for Illness 11 weeks for Accident ELIMINATION PERIOD Illness: 15 Days Accident: 15 Days LONG-TERM DISABILITY You are automatically enrolled in this employer-paid coverage. BENEFIT 60% of your earnings to a maximum of $12,000 a month DURATION Up to Social Security Normal Retirement Age ELIMINATION PERIOD 90 Days REVIEW PLAN SUMMARY VOLUNTARY SHORT-TERM DISABILITY REVIEW PLAN SUMMARY LONG-TERM DISABILITY

Whenever you travel 100 miles or more from home — to another country or just another city — be sure to pack your worldwide emergency travel assistance phone number. Travel assistance speaks your language, helping you locate hospitals, embassies and other “unexpected” travel destinations. ASSIST AMERICA WORLDWIDE TRAVEL ASSISTANCE Services available at no cost: • Emergency medical evacuation • Medical monitoring • Foreign hospital admission assistance • Medical repatriation • Medical consultations, evaluations, and referrals • Prescription medication assistance • Care of minor children • Interpreters and legal referrals • Emergency trauma counseling • Referrals to Western-trained, English-speaking medical providers • Legal and interpreter referrals • Passport replacement assistance Click on the icon below to learn more. TRAVEL ASSISTANCE

LEGAL Many of life’s moments—big and small—call for legal guidance. It’s not just handy for when trouble strikes, but for all kinds of reasons, from negotiating new home contracts to estate planning. LegalShield makes it easy to get the legal help you need. Have you ever... • Signed a contract? • Had concerns regarding child support? • Received a moving traffic violation? • Needed your Will prepared or updated? • Had trouble with a warranty or defective product? • Been overcharged for a repair or paid an unfair bill? CLICK HERE TO LEARN MORE

IDENTITY & FRAUD PROTECTION Recovering from identity theft can be a very frustrating situation and happens when someone takes your name and personal information and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services. To avoid a lengthy and often expensive recovery, identity theft protection benefits can help you protect you and your family against identity fraud. Identity fraud can happen to anyone — 39 million individuals in the United States were hit in 2023 alone. Unfortunately, even someone who knows how to minimize their exposure may still be at risk. That’s why your company provides Allstate Identity Protection Pro+ as a benefit. For over 90 years, Allstate has been protecting what matters most. Now get comprehensive identity monitoring and fraud resolution designed to help you protect yourself and your family against today’s digital threats. CLICK HERE TO LEARN MORE

PET INSURANCE At MetLife Pet Insurance, we get it — pets are like family. When a member of the family becomes sick or injured, you do whatever it takes to fix it. But those veterinary costs can add up quickly, which is where MetLife Pet Insurance plans can come in. MetLife’s pet insurance plans for dogs and cats can help reimburse you for unexpected vet bills. They can provide insurance for pets of all ages — even seniors — and you can customize your deductible and reimbursement rates so they work best for your pet’s needs and your budget. Click on the icon below to for plan details and enrollment information. PET INSURANCE EXOTIC PET COVERAGE WHAT TO EXPECT WHEN FILING A CLAIM

PSECU is dedicated to adhering to the utmost ethical standards when conducting business with, members, employees, business partners, etc. It is the obligation and expectation of all officials and employees to know, understand, and follow our code of ethics policy. PSECU is committed to providing outstanding service to members and potential members on a daily basis. It is our belief that outstanding service evolves from certain value elements such as reliability, convenience, accessibility, trust, confidentiality, and a range of services that address members’ needs. PENNSYLVANIA STATE EMPLOYEES CREDIT UNION CLICK HERE TO LEARN MORE Pennsylvania’s Largest Credit Union

Employee Perks As part of your Employee Benefits program you have access to the following employee discounts and savings programs. AAA Special Offer PNC WorkPlace Banking Sam’s Club Special Offer T-Mobile Work Perks

CONTACT INFORMATION Allstate 1-800-789-2720 https://www.myaip.com/achieva ID THEFT PROTECTION Metlife 1-800-438-6388 www.metlife.com/getpetquote PET INSURANCE UPMC 1-844-833-0527 www.lifesolutionsforyou.com EAP PSECU 800-237-7328 www.psecu.com CREDIT UNION Hartford 800-523-2233 www.thehartford.com/employee-benefits DISABILITY UPMC 844-220-4785 www.upmc.com MEDICAL UPMC 844-220-4785 www.upmc.com DENTAL UPMC 844-220-4785 www.upmc.com VISION Hartford 800-523-2233 www.thehartford.com/employee-benefits LIFE INSURANCE UPMC 844-220-4785 www.upmc.com FSA 1-800-654-7757 shieldbenefits.com/achieva memberservices@legalshield.com LEGAL SHIELD 412-995-5000 x650 hrsupport@achieva.info HR CONTACT

VIEW NOTICES EMPLOYEE NOTICES Please review the following required employee notices detailing your rights and options. You can also request a paper copy of any of these notices at any time.