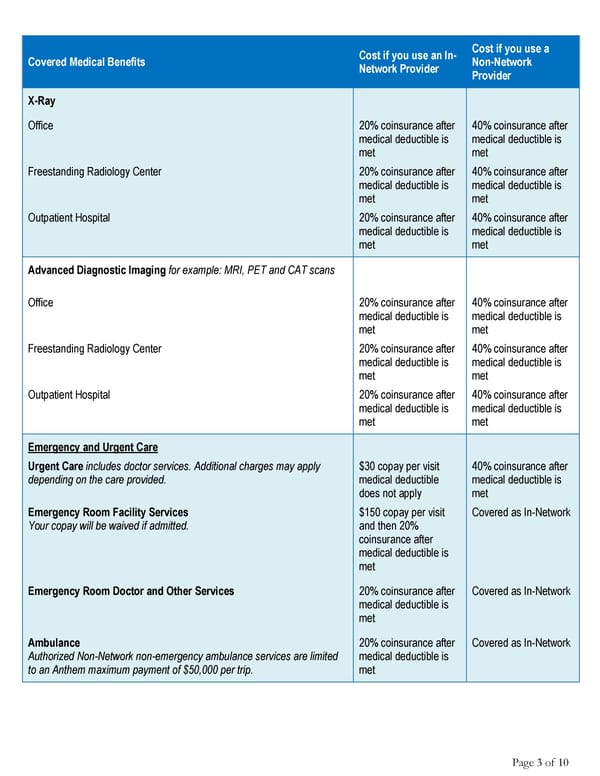

Cost if you use an In- Cost if you use a Covered Medical Benefits Network Provider Non-Network Provider X-Ray Office 20% coinsurance after 40% coinsurance after medical deductible is medical deductible is met met Freestanding Radiology Center 20% coinsurance after 40% coinsurance after medical deductible is medical deductible is met met Outpatient Hospital 20% coinsurance after 40% coinsurance after medical deductible is medical deductible is met met Advanced Diagnostic Imaging for example: MRI, PET and CAT scans Office 20% coinsurance after 40% coinsurance after medical deductible is medical deductible is met met Freestanding Radiology Center 20% coinsurance after 40% coinsurance after medical deductible is medical deductible is met met Outpatient Hospital 20% coinsurance after 40% coinsurance after medical deductible is medical deductible is met met Emergency and Urgent Care Urgent Care includes doctor services. Additional charges may apply $30 copay per visit 40% coinsurance after depending on the care provided. medical deductible medical deductible is does not apply met Emergency Room Facility Services $150 copay per visit Covered as In-Network Your copay will be waived if admitted. and then 20% coinsurance after medical deductible is met Emergency Room Doctor and Other Services 20% coinsurance after Covered as In-Network medical deductible is met Ambulance 20% coinsurance after Covered as In-Network Authorized Non-Network non-emergency ambulance services are limited medical deductible is to an Anthem maximum payment of $50,000 per trip. met Page 3 of 10

Anthem Classic PPO 500/30/50/20 Summary Page 2 Page 4

Anthem Classic PPO 500/30/50/20 Summary Page 2 Page 4