Critical Illnessv2

This document provides an overview of critical illness insurance benefits, including coverage options and eligible conditions under the Salus Homecare plan.

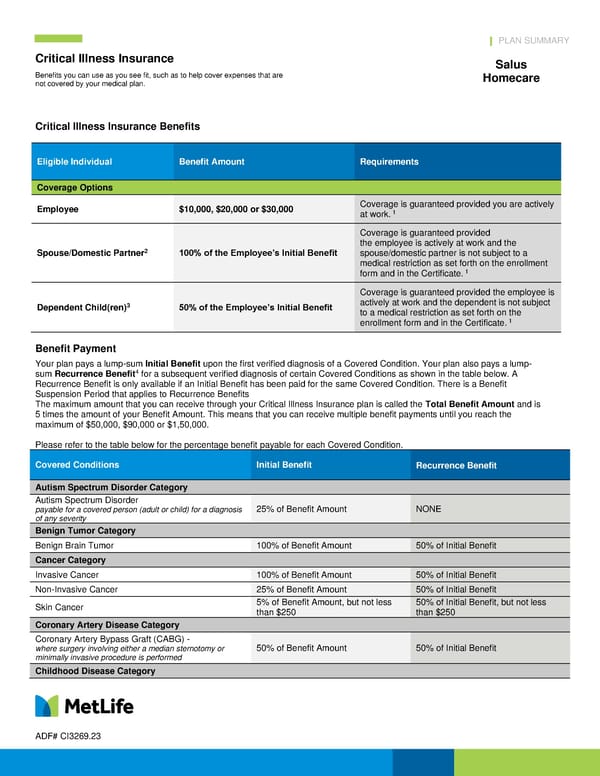

PLAN SUMMARY Critical Illness Insurance Benefits you can use as you see fit, such as to help cover expenses that are not covered by your medical plan. Salus Homecare ADF# CI3269.23 Critical Illness Insurance Benefits Benefit Payment Your plan pays a lump-sum Initial Benefit upon the first verified diagnosis of a Covered Condition. Your plan also pays a lump- sum Recurrence Benefit4 for a subsequent verified diagnosis of certain Covered Conditions as shown in the table below. A Recurrence Benefit is only available if an Initial Benefit has been paid for the same Covered Condition. There is a Benefit Suspension Period that applies to Recurrence Benefits The maximum amount that you can receive through your Critical Illness Insurance plan is called the Total Benefit Amount and is 5 times the amount of your Benefit Amount. This means that you can receive multiple benefit payments until you reach the maximum of $50,000, $90,000 or $1,50,000. Please refer to the table below for the percentage benefit payable for each Covered Condition. Covered Conditions Initial Benefit Recurrence Benefit Autism Spectrum Disorder Category Autism Spectrum Disorder payable for a covered person (adult or child) for a diagnosis of any severity 25% of Benefit Amount NONE Benign Tumor Category Benign Brain Tumor 100% of Benefit Amount 50% of Initial Benefit Cancer Category Invasive Cancer 100% of Benefit Amount 50% of Initial Benefit Non-Invasive Cancer 25% of Benefit Amount 50% of Initial Benefit Skin Cancer 5% of Benefit Amount, but not less than $250 50% of Initial Benefit, but not less than $250 Coronary Artery Disease Category Coronary Artery Bypass Graft (CABG) - where surgery involving either a median sternotomy or minimally invasive procedure is performed 50% of Benefit Amount 50% of Initial Benefit Childhood Disease Category Eligible Individual Benefit Amount Requirements Coverage Options Employee $10,000, $20,000 or $30,000 Coverage is guaranteed provided you are actively at work. 1 Spouse/Domestic Partner2 100% of the Employee’s Initial Benefit Coverage is guaranteed provided the employee is actively at work and the spouse/domestic partner is not subject to a medical restriction as set forth on the enrollment form and in the Certificate. 1 Dependent Child(ren)3 50% of the Employee’s Initial Benefit Coverage is guaranteed provided the employee is actively at work and the dependent is not subject to a medical restriction as set forth on the enrollment form and in the Certificate. 1

Critical Illnessv2 Page 2

Critical Illnessv2 Page 2