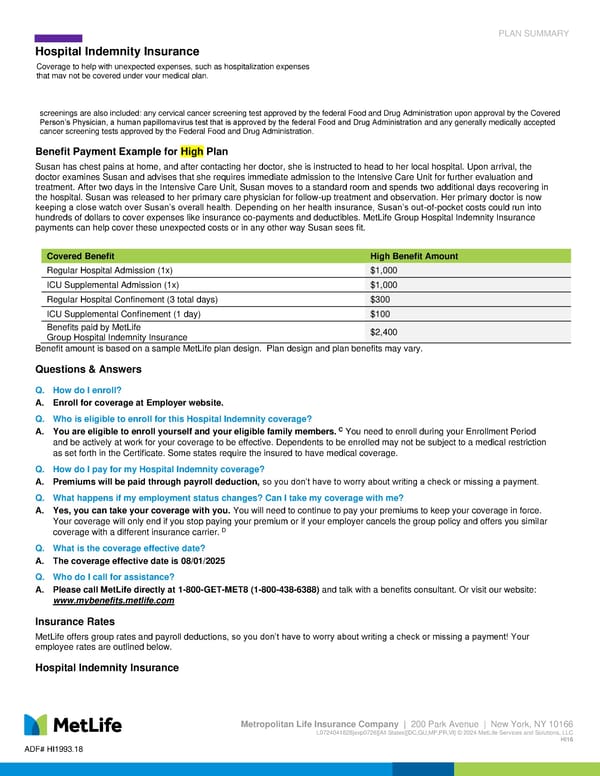

PLAN SUMMARY Hospital Indemnity Insurance Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166 L0724041828[exp0726][All States][DC,GU,MP,PR,VI] © 2024 MetLife Services and Solutions, LLC HI16 ADF# HI1993.18 Coverage to help with unexpected expenses, such as hospitalization expenses that may not be covered under your medical plan. screenings are also included: any cervical cancer screening test approved by the federal Food and Drug Administration upon approval by the Covered Person’s Physician, a human papillomavirus test that is approved by the federal Food and Drug Administration and any generally medically accepted cancer screening tests approved by the Federal Food and Drug Administration. Benefit Payment Example for High Plan Susan has chest pains at home, and after contacting her doctor, she is instructed to head to her local hospital. Upon arrival, the doctor examines Susan and advises that she requires immediate admission to the Intensive Care Unit for further evaluation and treatment. After two days in the Intensive Care Unit, Susan moves to a standard room and spends two additional days recovering in the hospital. Susan was released to her primary care physician for follow-up treatment and observation. Her primary doctor is now keeping a close watch over Susan’s overall health. Depending on her health insurance, Susan’s out-of-pocket costs could run into hundreds of dollars to cover expenses like insurance co-payments and deductibles. MetLife Group Hospital Indemnity Insurance payments can help cover these unexpected costs or in any other way Susan sees fit. Benefit amount is based on a sample MetLife plan design. Plan design and plan benefits may vary. Questions & Answers Q. How do I enroll? A. Enroll for coverage at Employer website. Q. Who is eligible to enroll for this Hospital Indemnity coverage? A. You are eligible to enroll yourself and your eligible family members. C You need to enroll during your Enrollment Period and be actively at work for your coverage to be effective. Dependents to be enrolled may not be subject to a medical restriction as set forth in the Certificate. Some states require the insured to have medical coverage. Q. How do I pay for my Hospital Indemnity coverage? A. Premiums will be paid through payroll deduction, so you don’t have to worry about writing a check or missing a payment. Q. What happens if my employment status changes? Can I take my coverage with me? A. Yes, you can take your coverage with you. You will need to continue to pay your premiums to keep your coverage in force. Your coverage will only end if you stop paying your premium or if your employer cancels the group policy and offers you similar coverage with a different insurance carrier. D Q. What is the coverage effective date? A. The coverage effective date is 08/01/2025 Q. Who do I call for assistance? A. Please call MetLife directly at 1-800-GET-MET8 (1-800-438-6388) and talk with a benefits consultant. Or visit our website: www.mybenefits.metlife.com Insurance Rates MetLife offers group rates and payroll deductions, so you don’t have to worry about writing a check or missing a payment! Your employee rates are outlined below. Hospital Indemnity Insurance Covered Benefit High Benefit Amount Regular Hospital Admission (1x) $1,000 ICU Supplemental Admission (1x) $1,000 Regular Hospital Confinement (3 total days) $300 ICU Supplemental Confinement (1 day) $100 Benefits paid by MetLife Group Hospital Indemnity Insurance $2,400

Hospitalv2 Page 2 Page 4

Hospitalv2 Page 2 Page 4