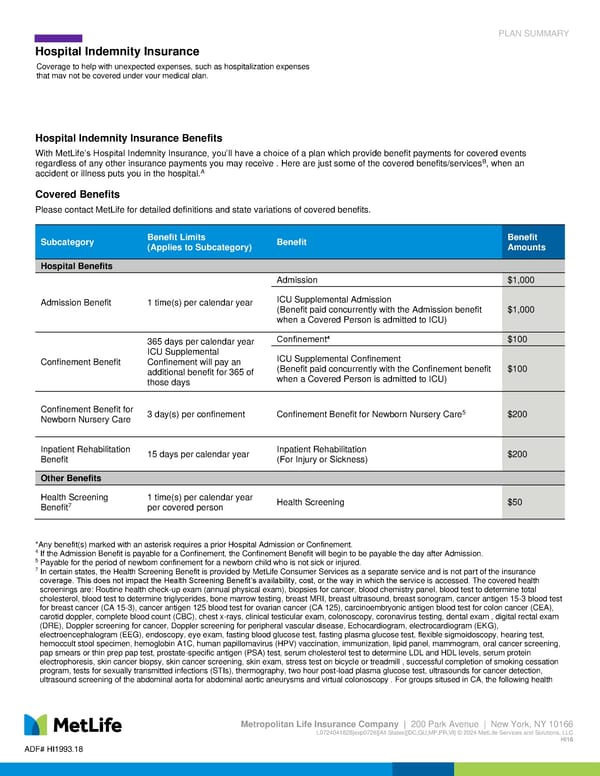

PLAN SUMMARY Hospital Indemnity Insurance Metropolitan Life Insurance Company | 200 Park Avenue | New York, NY 10166 L0724041828[exp0726][All States][DC,GU,MP,PR,VI] © 2024 MetLife Services and Solutions, LLC HI16 ADF# HI1993.18 Coverage to help with unexpected expenses, such as hospitalization expenses that may not be covered under your medical plan. Hospital Indemnity Insurance Benefits With MetLife’s Hospital Indemnity Insurance, you’ll have a choice of a plan which provide benefit payments for covered events regardless of any other insurance payments you may receive . Here are just some of the covered benefits/servicesB, when an accident or illness puts you in the hospital.A Covered Benefits Please contact MetLife for detailed definitions and state variations of covered benefits. Subcategory Benefit Limits (Applies to Subcategory) Benefit Benefit Amounts Hospital Benefits Admission Benefit 1 time(s) per calendar year Admission $1,000 ICU Supplemental Admission (Benefit paid concurrently with the Admission benefit when a Covered Person is admitted to ICU) $1,000 Confinement Benefit 365 days per calendar year ICU Supplemental Confinement will pay an additional benefit for 365 of those days Confinement⁴ $100 ICU Supplemental Confinement (Benefit paid concurrently with the Confinement benefit when a Covered Person is admitted to ICU) $100 Confinement Benefit for Newborn Nursery Care 3 day(s) per confinement Confinement Benefit for Newborn Nursery Care5 $200 Inpatient Rehabilitation Benefit 15 days per calendar year Inpatient Rehabilitation (For Injury or Sickness) $200 Other Benefits Health Screening Benefit7 1 time(s) per calendar year per covered person Health Screening $50 *Any benefit(s) marked with an asterisk requires a prior Hospital Admission or Confinement. 4 If the Admission Benefit is payable for a Confinement, the Confinement Benefit will begin to be payable the day after Admission. 5 Payable for the period of newborn confinement for a newborn child who is not sick or injured. 7 In certain states, the Health Screening Benefit is provided by MetLife Consumer Services as a separate service and is not part of the insurance coverage. This does not impact the Health Screening Benefit’s availability, cost, or the way in which the service is accessed. The covered health screenings are: Routine health check-up exam (annual physical exam), biopsies for cancer, blood chemistry panel, blood test to determine total cholesterol, blood test to determine triglycerides, bone marrow testing, breast MRI, breast ultrasound, breast sonogram, cancer antigen 15-3 blood test for breast cancer (CA 15-3), cancer antigen 125 blood test for ovarian cancer (CA 125), carcinoembryonic antigen blood test for colon cancer (CEA), carotid doppler, complete blood count (CBC), chest x-rays, clinical testicular exam, colonoscopy, coronavirus testing, dental exam , digital rectal exam (DRE), Doppler screening for cancer, Doppler screening for peripheral vascular disease, Echocardiogram, electrocardiogram (EKG), electroencephalogram (EEG), endoscopy, eye exam, fasting blood glucose test, fasting plasma glucose test, flexible sigmoidoscopy, hearing test, hemoccult stool specimen, hemoglobin A1C, human papillomavirus (HPV) vaccination, immunization, lipid panel, mammogram, oral cancer screening, pap smears or thin prep pap test, prostate-specific antigen (PSA) test, serum cholesterol test to determine LDL and HDL levels, serum protein electrophoresis, skin cancer biopsy, skin cancer screening, skin exam, stress test on bicycle or treadmill , successful completion of smoking cessation program, tests for sexually transmitted infections (STIs), thermography, two hour post-load plasma glucose test, ultrasounds for cancer detection, ultrasound screening of the abdominal aorta for abdominal aortic aneurysms and virtual colonoscopy . For groups sitused in CA, the following health

Hospitalv2 Page 1 Page 3

Hospitalv2 Page 1 Page 3