Supplemental Term Life v2

This document outlines the MetLife Supplemental Term Life insurance plan for Salus Homecare employees, effective August 1, 2025, with details on coverage increments, maximum benefits, and enrollment instructions.

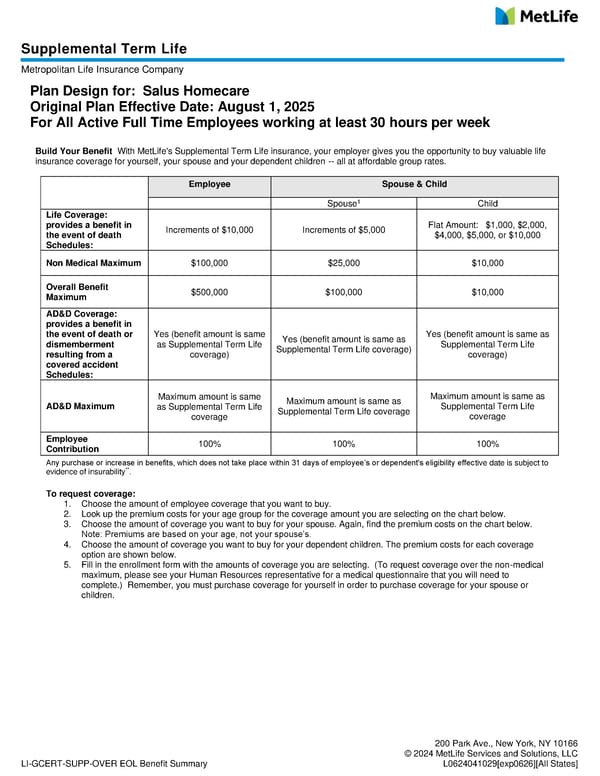

LI-GCERT-SUPP-OVER EOL Benefit Summary 200 Park Ave., New York, NY 10166 © 2024 MetLife Services and Solutions, LLC L0624041029[exp0626][All States] Supplemental Term Life Metropolitan Life Insurance Company Plan Design for: Salus Homecare Original Plan Effective Date: August 1, 2025 For All Active Full Time Employees working at least 30 hours per week Build Your Benefit With MetLife's Supplemental Term Life insurance, your employer gives you the opportunity to buy valuable life insurance coverage for yourself, your spouse and your dependent children -- all at affordable group rates. Employee Spouse & Child Spouse1 Child Life Coverage: provides a benefit in the event of death Schedules: Increments of $10,000 Increments of $5,000 Flat Amount: $1,000, $2,000, $4,000, $5,000, or $10,000 Non Medical Maximum $100,000 $25,000 $10,000 Overall Benefit Maximum $500,000 $100,000 $10,000 AD&D Coverage: provides a benefit in the event of death or dismemberment resulting from a covered accident Schedules: Yes (benefit amount is same as Supplemental Term Life coverage) Yes (benefit amount is same as Supplemental Term Life coverage) Yes (benefit amount is same as Supplemental Term Life coverage) AD&D Maximum Maximum amount is same as Supplemental Term Life coverage Maximum amount is same as Supplemental Term Life coverage Maximum amount is same as Supplemental Term Life coverage Employee Contribution 100% 100% 100% Any purchase or increase in benefits, which does not take place within 31 days of employee’s or dependent's eligibility effective date is subject to evidence of insurability**. To request coverage: 1. Choose the amount of employee coverage that you want to buy. 2. Look up the premium costs for your age group for the coverage amount you are selecting on the chart below. 3. Choose the amount of coverage you want to buy for your spouse. Again, find the premium costs on the chart below. Note: Premiums are based on your age, not your spouse’s. 4. Choose the amount of coverage you want to buy for your dependent children. The premium costs for each coverage option are shown below. 5. Fill in the enrollment form with the amounts of coverage you are selecting. (To request coverage over the non-medical maximum, please see your Human Resources representative for a medical questionnaire that you will need to complete.) Remember, you must purchase coverage for yourself in order to purchase coverage for your spouse or children.

Supplemental Term Life v2 Page 2

Supplemental Term Life v2 Page 2