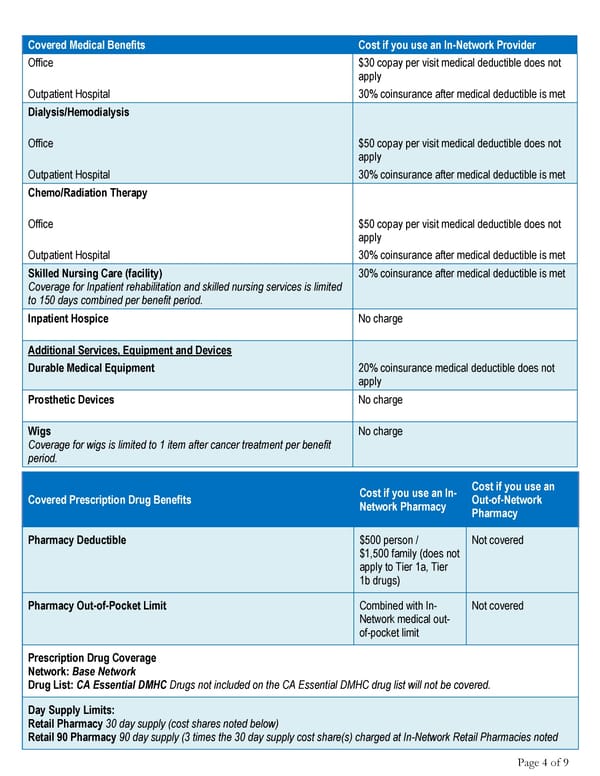

Page 4 of 9 Covered Medical Benefits Cost if you use an In-Network Provider Office $30 copay per visit medical deductible does not apply Outpatient Hospital 30% coinsurance after medical deductible is met Dialysis/Hemodialysis Office $50 copay per visit medical deductible does not apply Outpatient Hospital 30% coinsurance after medical deductible is met Chemo/Radiation Therapy Office $50 copay per visit medical deductible does not apply Outpatient Hospital 30% coinsurance after medical deductible is met Skilled Nursing Care (facility) Coverage for Inpatient rehabilitation and skilled nursing services is limited to 150 days combined per benefit period. 30% coinsurance after medical deductible is met Inpatient Hospice No charge Additional Services, Equipment and Devices Durable Medical Equipment 20% coinsurance medical deductible does not apply Prosthetic Devices No charge Wigs Coverage for wigs is limited to 1 item after cancer treatment per benefit period. No charge Covered Prescription Drug Benefits Cost if you use an In- Network Pharmacy Cost if you use an Out-of-Network Pharmacy Pharmacy Deductible $500 person / $1,500 family (does not apply to Tier 1a, Tier 1b drugs) Not covered Pharmacy Out-of-Pocket Limit Combined with In- Network medical out- of-pocket limit Not covered Prescription Drug Coverage Network: Base Network Drug List: CA Essential DMHC Drugs not included on the CA Essential DMHC drug list will not be covered. Day Supply Limits: Retail Pharmacy 30 day supply (cost shares noted below) Retail 90 Pharmacy 90 day supply (3 times the 30 day supply cost share(s) charged at In-Network Retail Pharmacies noted

Your Summary of Benefits - Anthem Blue Cross Page 3 Page 5

Your Summary of Benefits - Anthem Blue Cross Page 3 Page 5