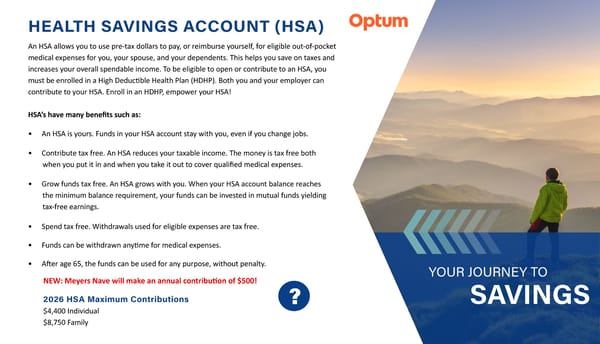

6 HEALTH SAVINGS ACCOUNT (HSA) An HSA allows you to use pre-tax dollars to pay, or reimburse yourself, for eligible out-of-pocket medical expenses for you, your spouse, and your dependents. This helps you save on taxes and increases your overall spendable income. To be eligible to open or contribute to an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). Both you and your employer can contribute to your HSA. Enroll in an HDHP, empower your HSA! HSA’s have many benefits such as: • An HSA is yours. Funds in your HSA account stay with you, even if you change jobs. • Contribute tax free. An HSA reduces your taxable income. The money is tax free both when you put it in and when you take it out to cover qualified medical expenses. • Grow funds tax free. An HSA grows with you. When your HSA account balance reaches the minimum balance requirement, your funds can be invested in mutual funds yielding tax-free earnings. • Spend tax free. Withdrawals used for eligible expenses are tax free. • Funds can be withdrawn anytime for medical expenses. • After age 65, the funds can be used for any purpose, without penalty. 2026 HSA Maximum Contributions $4,400 Individual $8,750 Family YOUR JOURNEY TO SAVINGS ? NEW: Meyers Nave will make an annual contribution of $500!

2026 Benefits Guide Page 5 Page 7

2026 Benefits Guide Page 5 Page 7