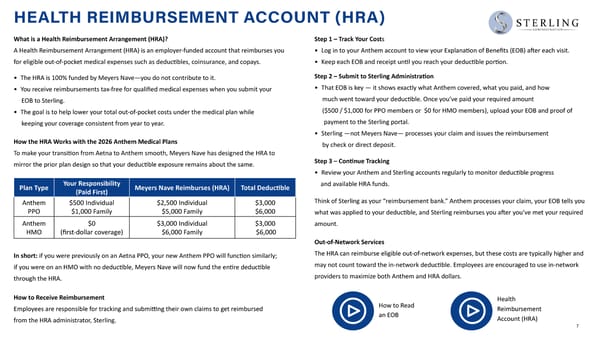

7 What is a Health Reimbursement Arrangement (HRA)? A Health Reimbursement Arrangement (HRA) is an employer-funded account that reimburses you for eligible out-of-pocket medical expenses such as deductibles, coinsurance, and copays. • The HRA is 100% funded by Meyers Nave—you do not contribute to it. • You receive reimbursements tax-free for qualified medical expenses when you submit your EOB to Sterling. • The goal is to help lower your total out-of-pocket costs under the medical plan while keeping your coverage consistent from year to year. How the HRA Works with the 2026 Anthem Medical Plans To make your transition from Aetna to Anthem smooth, Meyers Nave has designed the HRA to mirror the prior plan design so that your deductible exposure remains about the same. In short: if you were previously on an Aetna PPO, your new Anthem PPO will function similarly; if you were on an HMO with no deductible, Meyers Nave will now fund the entire deductible through the HRA. How to Receive Reimbursement Employees are responsible for tracking and submitting their own claims to get reimbursed from the HRA administrator, Sterling. Step 1 – Track Your Costs • Log in to your Anthem account to view your Explanation of Benefits (EOB) after each visit. • Keep each EOB and receipt until you reach your deductible portion. Step 2 – Submit to Sterling Administration • That EOB is key — it shows exactly what Anthem covered, what you paid, and how much went toward your deductible. Once you’ve paid your required amount ($500 / $1,000 for PPO members or $0 for HMO members), upload your EOB and proof of payment to the Sterling portal. • Sterling —not Meyers Nave— processes your claim and issues the reimbursement by check or direct deposit. Step 3 – Continue Tracking • Review your Anthem and Sterling accounts regularly to monitor deductible progress and available HRA funds. Think of Sterling as your “reimbursement bank.” Anthem processes your claim, your EOB tells you what was applied to your deductible, and Sterling reimburses you after you’ve met your required amount. Out-of-Network Services The HRA can reimburse eligible out-of-network expenses, but these costs are typically higher and may not count toward the in-network deductible. Employees are encouraged to use in-network providers to maximize both Anthem and HRA dollars. Plan Type Your Responsibility (Paid First) Meyers Nave Reimburses (HRA) Total Deductible Anthem PPO $500 Individual $1,000 Family $2,500 Individual $5,000 Family $3,000 $6,000 Anthem HMO $0 (first-dollar coverage) $3,000 Individual $6,000 Family $3,000 $6,000 HEALTH REIMBURSEMENT ACCOUNT (HRA) How to Read an EOB Health Reimbursement Account (HRA)

2026 Benefits Guide Page 6 Page 8

2026 Benefits Guide Page 6 Page 8