2026 Benefits Guide

This document provides a comprehensive overview of the benefits plan for Meyers Nave employees for the year 2026, covering the period from January 1st to December 31st.

2026 Benefits Guide YOUR BENEFITS JOURNEY Plan Year: Jan 1st - Dec 31st

2 ENROLLMENT STAR T S H E R E Y O U R J O U R N E Y T O HOW TO USE THIS GUIDE When you see the icons below, click to link out to websites, download documents, or learn more! ? Carrier Logos Learn More

3 ENROLLMENT & ELIGIBILITY Employee Eligibility All full-time employees working 30 or more hours per week are eligible for Firm offered benefit plans on date of hire. Dependent Eligibility Benefit eligible employees may also enroll their dependents, who are defined as follows: • Your spouse or domestic partner • Your dependent children to age 26 Special Enrollment Period Once annual open enrollment closes, employees may only make benefit elections if they experience a qualifying life event. Examples include loss of other coverage, marriage, birthing, fostering, or adopting a baby. To change your elections, you must notify Human Resources within 30 days of a qualifying life event. ENROLL HERE

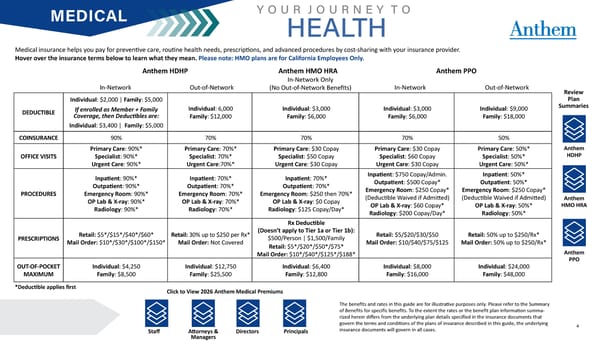

4 MEDICAL Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Hover over the insurance terms below to learn what they mean. Please note: HMO plans are for California Employees Only. Y O U R J O U R N E Y T O HEALTH DEDUCTIBLE Individual: $2,000 | Family: $5,000 If enrolled as Member + Family Coverage, then Deductibles are: Individual: $3,400 | Family: $5,000 Individual: 6,000 Family: $12,000 Individual: $3,000 Family: $6,000 Individual: $3,000 Family: $6,000 Individual: $9,000 Family: $18,000 COINSURANCE 90% 70% 70% 70% 50% OFFICE VISITS Primary Care: 90%* Specialist: 90%* Urgent Care: 90%* Primary Care: 70%* Specialist: 70%* Urgent Care:70%* Primary Care: $30 Copay Specialist: $50 Copay Urgent Care: $30 Copay Primary Care: $30 Copay Specialist: $60 Copay Urgent Care: $30 Copay Primary Care: 50%* Specialist: 50%* Urgent Care: 50%* PROCEDURES Inpatient: 90%* Outpatient: 90%* Emergency Room: 90%* OP Lab & X-ray: 90%* Radiology: 90%* Inpatient: 70%* Outpatient: 70%* Emergency Room: 70%* OP Lab & X-ray: 70%* Radiology: 70%* Inpatient: 70%* Outpatient: 70%* Emergency Room: $250 then 70%* OP Lab & X-ray: $0 Copay Radiology: $125 Copay/Day* Inpatient: $750 Copay/Admin. Outpatient: $500 Copay* Emergency Room: $250 Copay* (Deductible Waived if Admitted) OP Lab & X-ray: $60 Copay* Radiology: $200 Copay/Day* Inpatient: 50%* Outpatient: 50%* Emergency Room: $250 Copay* (Deductible Waived if Admitted) OP Lab & X-ray: 50%* Radiology: 50%* PRESCRIPTIONS Retail: $5*/$15*/$40*/$60* Mail Order: $10*/$30*/$100*/$150* Retail: 30% up to $250 per Rx* Mail Order: Not Covered Rx Deductible (Doesn’t apply to Tier 1a or Tier 1b): $500/Person | $1,500/Family Retail: $5*/$20*/$50*/$75* Mail Order: $10*/$40*/$125*/$188* Retail: $5/$20/$30/$50 Mail Order: $10/$40/$75/$125 Retail: 50% up to $250/Rx* Mail Order: 50% up to $250/Rx* OUT-OF-POCKET MAXIMUM Individual: $4,250 Family: $8,500 Individual: $12,750 Family: $25,500 Individual: $6,400 Family: $12,800 Individual: $8,000 Family: $16,000 Individual: $24,000 Family: $48,000 Anthem HDHP Anthem HMO HRA Anthem PPO *Deductible applies first Review Plan Summaries Anthem HDHP Anthem HMO HRA Anthem PPO In-Network In-Network Only (No Out-of-Network Benefits) In-Network Out-of-Network Out-of-Network Click to View 2026 Anthem Medical Premiums The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summa- rized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. Staff Principals Directors Attorneys & Managers

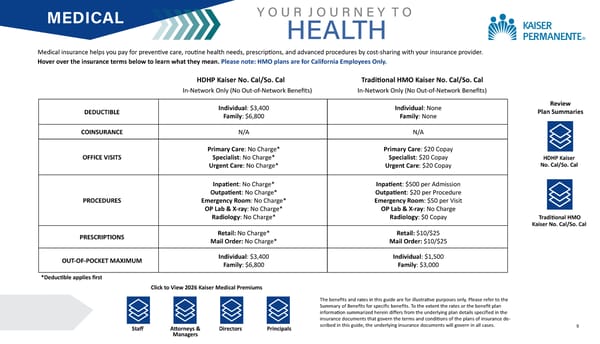

5 MEDICAL Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Hover over the insurance terms below to learn what they mean. Please note: HMO plans are for California Employees Only. Y O U R J O U R N E Y T O HEALTH DEDUCTIBLE Individual: $3,400 Family: $6,800 Individual: None Family: None COINSURANCE N/A N/A OFFICE VISITS Primary Care: No Charge* Specialist: No Charge* Urgent Care: No Charge* Primary Care: $20 Copay Specialist: $20 Copay Urgent Care: $20 Copay PROCEDURES Inpatient: No Charge* Outpatient: No Charge* Emergency Room: No Charge* OP Lab & X-ray: No Charge* Radiology: No Charge* Inpatient: $500 per Admission Outpatient: $20 per Procedure Emergency Room: $50 per Visit OP Lab & X-ray: No Charge Radiology: $0 Copay PRESCRIPTIONS Retail: No Charge* Mail Order: No Charge* Retail: $10/$25 Mail Order: $10/$25 OUT-OF-POCKET MAXIMUM Individual: $3,400 Family: $6,800 Individual: $1,500 Family: $3,000 HDHP Kaiser No. Cal/So. Cal Traditional HMO Kaiser No. Cal/So. Cal Review Plan Summaries HDHP Kaiser No. Cal/So. Cal Traditional HMO Kaiser No. Cal/So. Cal In-Network Only (No Out-of-Network Benefits) *Deductible applies first The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance de- scribed in this guide, the underlying insurance documents will govern in all cases. Click to View 2026 Kaiser Medical Premiums Staff Principals Directors In-Network Only (No Out-of-Network Benefits) Attorneys & Managers

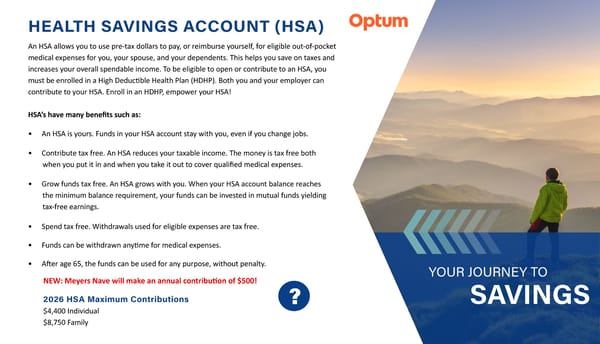

6 HEALTH SAVINGS ACCOUNT (HSA) An HSA allows you to use pre-tax dollars to pay, or reimburse yourself, for eligible out-of-pocket medical expenses for you, your spouse, and your dependents. This helps you save on taxes and increases your overall spendable income. To be eligible to open or contribute to an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). Both you and your employer can contribute to your HSA. Enroll in an HDHP, empower your HSA! HSA’s have many benefits such as: • An HSA is yours. Funds in your HSA account stay with you, even if you change jobs. • Contribute tax free. An HSA reduces your taxable income. The money is tax free both when you put it in and when you take it out to cover qualified medical expenses. • Grow funds tax free. An HSA grows with you. When your HSA account balance reaches the minimum balance requirement, your funds can be invested in mutual funds yielding tax-free earnings. • Spend tax free. Withdrawals used for eligible expenses are tax free. • Funds can be withdrawn anytime for medical expenses. • After age 65, the funds can be used for any purpose, without penalty. 2026 HSA Maximum Contributions $4,400 Individual $8,750 Family YOUR JOURNEY TO SAVINGS ? NEW: Meyers Nave will make an annual contribution of $500!

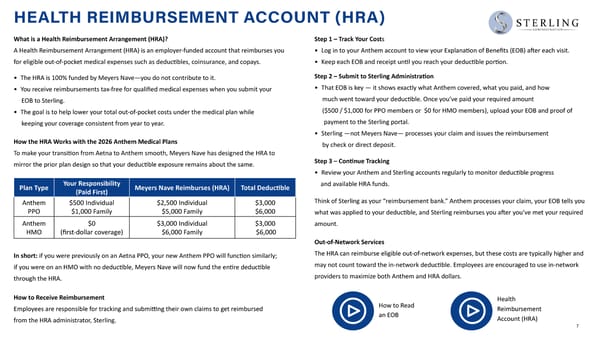

7 What is a Health Reimbursement Arrangement (HRA)? A Health Reimbursement Arrangement (HRA) is an employer-funded account that reimburses you for eligible out-of-pocket medical expenses such as deductibles, coinsurance, and copays. • The HRA is 100% funded by Meyers Nave—you do not contribute to it. • You receive reimbursements tax-free for qualified medical expenses when you submit your EOB to Sterling. • The goal is to help lower your total out-of-pocket costs under the medical plan while keeping your coverage consistent from year to year. How the HRA Works with the 2026 Anthem Medical Plans To make your transition from Aetna to Anthem smooth, Meyers Nave has designed the HRA to mirror the prior plan design so that your deductible exposure remains about the same. In short: if you were previously on an Aetna PPO, your new Anthem PPO will function similarly; if you were on an HMO with no deductible, Meyers Nave will now fund the entire deductible through the HRA. How to Receive Reimbursement Employees are responsible for tracking and submitting their own claims to get reimbursed from the HRA administrator, Sterling. Step 1 – Track Your Costs • Log in to your Anthem account to view your Explanation of Benefits (EOB) after each visit. • Keep each EOB and receipt until you reach your deductible portion. Step 2 – Submit to Sterling Administration • That EOB is key — it shows exactly what Anthem covered, what you paid, and how much went toward your deductible. Once you’ve paid your required amount ($500 / $1,000 for PPO members or $0 for HMO members), upload your EOB and proof of payment to the Sterling portal. • Sterling —not Meyers Nave— processes your claim and issues the reimbursement by check or direct deposit. Step 3 – Continue Tracking • Review your Anthem and Sterling accounts regularly to monitor deductible progress and available HRA funds. Think of Sterling as your “reimbursement bank.” Anthem processes your claim, your EOB tells you what was applied to your deductible, and Sterling reimburses you after you’ve met your required amount. Out-of-Network Services The HRA can reimburse eligible out-of-network expenses, but these costs are typically higher and may not count toward the in-network deductible. Employees are encouraged to use in-network providers to maximize both Anthem and HRA dollars. Plan Type Your Responsibility (Paid First) Meyers Nave Reimburses (HRA) Total Deductible Anthem PPO $500 Individual $1,000 Family $2,500 Individual $5,000 Family $3,000 $6,000 Anthem HMO $0 (first-dollar coverage) $3,000 Individual $6,000 Family $3,000 $6,000 HEALTH REIMBURSEMENT ACCOUNT (HRA) How to Read an EOB Health Reimbursement Account (HRA)

8 FLEXIBLE SPENDING ACCOUNTS (FSAs) Health Care FSA A Health Care Flexible Spending Account (FSA) provides you with the ability to save money on a pre-tax basis to pay for any IRS-allowed health expense that is not covered by your health care plan. Examples of these types of expenses include deductibles, copayments, coinsurance payments and uninsured dental and vision care expenses. You may elect a specific annual contribution for each FSA in which you plan to participate. Your annual contribution is then divided by your number of pay periods and that amount will be deducted pre-tax each pay period. The amount you elect may not be changed or revoked during the plan year unless you experience a qualifying life event. Limited Purpose FSA A Limited Purpose Flexible Spending Account (LPFSA) is a tax-advantaged account specifically designed for dental and vision expenses, often paired with a Health Savings Account (HSA). It allows you to use pre-tax dollars to pay for eligible costs like dental cleanings, braces, eyeglasses, and vision exams. Dependent Care FSA A Dependent Care FSA provides you with the ability to save money on a pre-tax basis for day care expenses for your child, disabled parent or spouse. Transportation and Parking FSA Transportation Spending Account allows employees to use money on a pre-tax basis to pay for qualified work-related commuting and parking expenses. 2026 FSA Maximum Contributions Health Care FSA: $3,400 Limited Purpose FSA: $3,400 Dependent Care FSA: $7,500 Transportation: $340 per month Parking: $340 per month YOUR JOURNEY TO SAVINGS ? Commuter Benefits

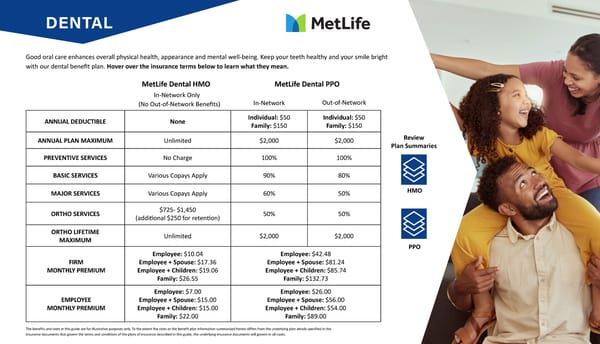

9 DENTAL Good oral care enhances overall physical health, appearance and mental well-being. Keep your teeth healthy and your smile bright with our dental benefit plan. Hover over the insurance terms below to learn what they mean. ANNUAL DEDUCTIBLE None Individual: $50 Family: $150 Individual: $50 Family: $150 ANNUAL PLAN MAXIMUM Unlimited $2,000 $2,000 PREVENTIVE SERVICES No Charge 100% 100% BASIC SERVICES Various Copays Apply 90% 80% MAJOR SERVICES Various Copays Apply 60% 50% ORTHO SERVICES $725- $1,450 (additional $250 for retention) 50% 50% ORTHO LIFETIME MAXIMUM Unlimited $2,000 $2,000 FIRM MONTHLY PREMIUM Employee: $10.04 Employee + Spouse: $17.36 Employee + Children: $19.06 Family: $26.55 Employee: $42.48 Employee + Spouse: $81.24 Employee + Children: $85.74 Family: $132.73 EMPLOYEE MONTHLY PREMIUM Employee: $7.00 Employee + Spouse: $15.00 Employee + Children: $15.00 Family: $22.00 Employee: $26.00 Employee + Spouse: $56.00 Employee + Children: $54.00 Family: $89.00 MetLife Dental HMO MetLife Dental PPO The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. HMO PPO Review Plan Summaries In-Network In-Network Only Out-of-Network (No Out-of-Network Benefits)

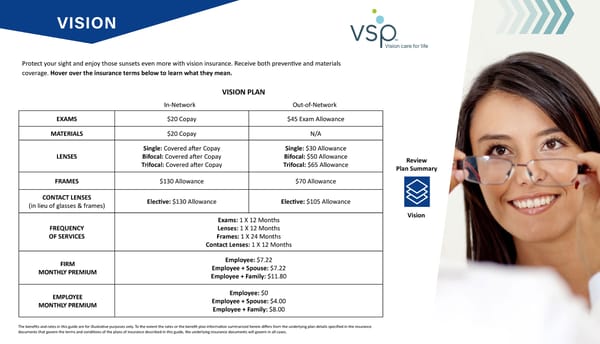

10 VISION Protect your sight and enjoy those sunsets even more with vision insurance. Receive both preventive and materials coverage. Hover over the insurance terms below to learn what they mean. EXAMS $20 Copay $45 Exam Allowance MATERIALS $20 Copay N/A LENSES Single: Covered after Copay Bifocal: Covered after Copay Trifocal: Covered after Copay Single: $30 Allowance Bifocal: $50 Allowance Trifocal: $65 Allowance FRAMES $130 Allowance $70 Allowance CONTACT LENSES (in lieu of glasses & frames) Elective: $130 Allowance Elective: $105 Allowance FREQUENCY OF SERVICES Exams: 1 X 12 Months Lenses: 1 X 12 Months Frames: 1 X 24 Months Contact Lenses: 1 X 12 Months FIRM MONTHLY PREMIUM Employee: $7.22 Employee + Spouse: $7.22 Employee + Family: $11.80 EMPLOYEE MONTHLY PREMIUM Employee: $0 Employee + Spouse: $4.00 Employee + Family: $8.00 VISION PLAN The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. Vision Review Plan Summary In-Network Out-of-Network

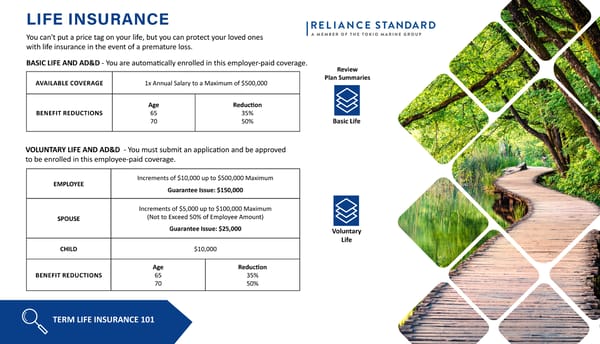

11 LIFE INSURANCE You can't put a price tag on your life, but you can protect your loved ones with life insurance in the event of a premature loss. BASIC LIFE AND AD&D - You are automatically enrolled in this employer-paid coverage. AVAILABLE COVERAGE 1x Annual Salary to a Maximum of $500,000 BENEFIT REDUCTIONS Age 65 70 Reduction 35% 50% VOLUNTARY LIFE AND AD&D - You must submit an application and be approved to be enrolled in this employee-paid coverage. EMPLOYEE Increments of $10,000 up to $500,000 Maximum Guarantee Issue: $150,000 SPOUSE Increments of $5,000 up to $100,000 Maximum (Not to Exceed 50% of Employee Amount) Guarantee Issue: $25,000 CHILD $10,000 BENEFIT REDUCTIONS Age 65 70 Reduction 35% 50% TERM LIFE INSURANCE 101 Basic Life Voluntary Life Review Plan Summaries

12 DISABILITY Accidents and illnesses happen and often when we least expect them. Ensure you are financially prepared to stay afloat during a medical condition with disability insurance. SHORT-TERM DISABILITY 101 LONG-TERM DISABILITY 101 SHORT-TERM DISABILITY You are automatically enrolled in this employer-paid coverage. BENEFIT Class 1: 66.67% of Salary to a Maximum of $4,000 a Week Class 2: 60% of Salary to a Maximum of $2,100 a Week DURATION 13 Weeks for Sickness 13 weeks for Accident 22 Weeks for Sickness 22 weeks for Accident BENEFITS BEGIN Class 1: Illness: 91st Day Accident: 91st Day Class 2: Illness: 30th Day (Class 2) Accident: 30th Day (Class 2) LONG-TERM DISABILITY You are automatically enrolled in this employer-paid coverage. STD Class 1- Principals STD Class 2-Non-Principal Employees LTD Class 1- Principals LTD Class 2 - Non-Principal Employees Review Plan Summaries BENEFIT Class 1: 66.67% of Covered Earnings to a Benefit Max of $12,500 per Month Class 2: 60% of Salary to a Maximum of $10,000 a Month ELIMINATION PERIOD 180 Days DURATION Social Security Normal Retirement Age

13 VOLUNTARY BENEFITS Even with medical insurance, you could still be subject to unexpected out-of-pocket expenses in the form of copays, deductible, and coinsurance. These Voluntary Benefits provide lump sum payments to be used towards your health care expenses, or however you see fit. ACCIDENT INSURANCE CRITICAL ILLNESS HOSPITAL INDEMNITY Click on the icons to the right to learn more about each of these benefits. MONTHLY PREMIUM Employee: $11.60 Employee + Spouse: $18.12 Employee + Children: $22.36 Family: $29.35 MONTHLY PREMIUM Employee: $19.14 Employee + Spouse: $36.89 Employee + Children: $26.86 Family: $44.15 Age 0-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75-79 80-84 85+ Rates $0.55 $1.03 $1.27 $1.34 $1.51 $2.04 $2.73 $3.90 $5.23 $7.12 $9.05 $11.28 $13.40 Monthly Rates per $1,000 of Coverage for Employee and Spouse NEW BENEFIT OFFERING

14 CLAREMONT EAP There are times when everyone needs a little help or advise. The confidential Employee Assistance Program through Claremont Insurance Services can help you with things like stress, anxiety, depression, chemical dependency, relationship issues, legal issues, parenting questions, financial counseling, and dependent care resources. Best of all, the cost is paid by Meyers Nave. Help is available 24/7, 365 days a year by telephone at 1-800-834-3773. Other resources are available online at claremonteap.com In-person counseling may also be available, depending on the type of help you need. The program allows you and your family/household members up to 8 visits (per incident per year). Additional benefits are available through Reliance Matrix and your medical plan. Review your medical benefit summary for more information. WELLBEING If you think your physical health alone is related to your overall performance, think again. Total Wellbeing as a whole is comprised of 5 elements: physical, financial, communal, emotional, and purpose. To build your overall wellbeing, you have to make sure all of these elements are being “exercised”. Employee Assistance Program (EAP)

15 RETIREMENT BENEFITS 401(k) Retirement Plan One of the best ways to ensure a secure retirement is to start saving as early as possible. Our 401(k) savings plan allows you to save for retirement on a pretax basis. You can begin contributing to the plan at any time once you become eligible and start making contributions to your account through convenient payroll deductions. Eligibility All US-based employees over the age of 18 are eligible to participate in the Firm’s retirement savings plan. Enrollment You can enroll in the retirement savings plan by visiting your plan provider’s website and registering with your personal information. Once registered, you’ll be able to select your contribution percentage. Increase Your Retirement Savings with a 401(k) • Contribute using convenient payroll deductions up to the IRS limit of $24,500 per year. • Change the amount of your contributions or stop your payroll contributions at any time. • Decide how to invest your 401(k) or allow the plan to choose for you. • The 401(k) contribution limit for employees age 50 or older is $32,500 in 2026.

16 PET INSURANCE Nobody wants to imagine their pet getting sick or injured - but when it comes to your pet’s health, it’s best to expect the unexpected. Wishbone is accepted at any vet in the U.S., including emergency hospitals. Our simple online claims process means you get your money back fast, whether it’s for routine care or an accident. Protecting your pet’s health and your finances has never been easier! Pet Insurance Plan Options Essential Plan: $14.00/Month Premium Plan: $23.00/Month For enrollment portal follow this link: https://www.wishboneinsurance.com/meyersnave Benefits Video

17 ArmadaCare Ultimate Health Supplemental Executive Medical Reimbursement The Ultimate Health program provides medical reimbursement insurance intended to supplement your primary medical coverage. Certain expenses incurred by you and your eligible dependents are qualified for reimbursement: Medical Reimbursement Insurance Per Occurrence Limit $5,000 for those enrolled in an HMO, HDHP or PPO Eligible Expenses Unreimbursed medical, dental, and vision care expenses not covered by your health plans.

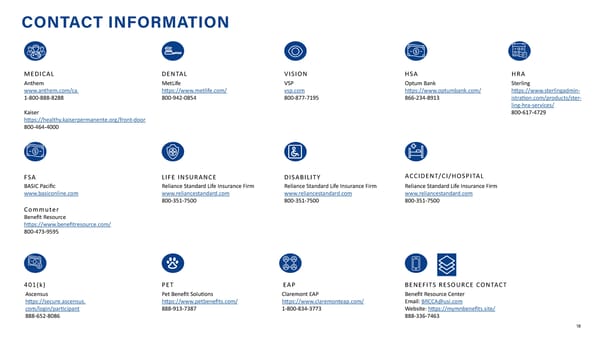

18 CONTACT INFORMATION Anthem www.anthem.com/ca 1-800-888-8288 Kaiser https://healthy.kaiserpermanente.org/front-door 800-464-4000 MetLife https://www.metlife.com/ 800-942-0854 VSP vsp.com 800-877-7195 Reliance Standard Life Insurance Firm www.reliancestandard.com 800-351-7500 Reliance Standard Life Insurance Firm www.reliancestandard.com 800-351-7500 BASIC Pacific www.basiconline.com Commuter Benefit Resource https://www.benefitresource.com/ 800-473-9595 Pet Benefit Solutions https://www.petbenefits.com/ 888-913-7387 MEDICAL DENTAL VISION LIFE INSURANCE DISABILITY FSA PET Reliance Standard Life Insurance Firm www.reliancestandard.com 800-351-7500 ACCIDENT/CI/HOSPITAL Optum Bank https://www.optumbank.com/ 866-234-8913 HSA Ascensus https://secure.ascensus. com/login/participant 888-652-8086 401(k) Benefit Resource Center Email: [email protected] Website: https://mymnbenefits.site/ 888-336-7463 BENEFITS RESOURCE CONTACT Claremont EAP https://www.claremonteap.com/ 1-800-834-3773 EAP Sterling https://www.sterlingadmin- istration.com/products/ster- ling-hra-services/ 800-617-4729 HRA

19 VIEW NOTICES EMPLOYEE NOTICES Please review the following required employee notices detailing your rights and options. You can also request a paper copy of any of these notices at any time.