SALUS 2025 Benefits Guide

This document outlines the benefits offered for the 2025 plan year, from August 1st to July 31st.

2025 Benefits Guide YOUR BENEFITS JOURNEY Plan Year: Aug 1st - July 31st

2 ENROLLMENT S TARTS H E RE Y O U R J O U R N E Y T O HOW TO USE THIS GUIDE When you see the icons below, click to link out to websites, download documents, or learn more! ? Carrier Logos Learn More

3 ENROLLMENT & ELIGIBILITY Employee Eligibility All full-time employees working 32 or more hours per week are eligible for company offered benefit plans first of the month following 60 days of FT employment. Dependent Eligibility Employees who are eligible to participate in the Salus Homcare benefit program may also enroll their dependents. For the purposes of our benefit plans, your dependents are defined as follows: • Your spouse or domestic partner • Your dependent children to age 26 Mid-Year Changes Once your enrollment window closes, the only time you are allowed to make changes to your benefits elections in the middle of the year is if you experience a qualifying life event. Examples may include getting married or divorced, having a baby or adopting, or gaining or losing coverage. You must notify Human Resources within 30 days of qualifying life event to be eligible to change your elections. Enrollment Instructions 1. Review your enrollment materials, including this benefit guide for valuable information. 2. Take your enrollment package home to discuss your options and evaluate your needs with your spouse/family (if applicable). 3. Complete and submit your enrollment in Viventium. Your Human Resource Contact: Sunny Song | [email protected] | 949-390-7308 ENROLL HERE

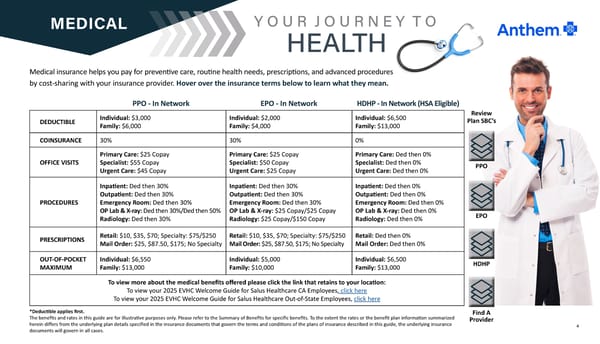

4 MEDICAL Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Hover over the insurance terms below to learn what they mean. Y O U R J O U R N E Y T O HEALTH DEDUCTIBLE Individual: $3,000 Family: $6,000 Individual: $2,000 Family: $4,000 Individual: $6,500 Family: $13,000 COINSURANCE 30% 30% 0% OFFICE VISITS Primary Care: $25 Copay Specialist: $55 Copay Urgent Care: $45 Copay Primary Care: $25 Copay Specialist: $50 Copay Urgent Care: $25 Copay Primary Care: Ded then 0% Specialist: Ded then 0% Urgent Care: Ded then 0% PROCEDURES Inpatient: Ded then 30% Outpatient: Ded then 30% Emergency Room: Ded then 30% OP Lab & X-ray: Ded then 30%/Ded then 50% Radiology: Ded then 30% Inpatient: Ded then 30% Outpatient: Ded then 30% Emergency Room: Ded then 30% OP Lab & X-ray: $25 Copay/$25 Copay Radiology: $25 Copay/$150 Copay Inpatient: Ded then 0% Outpatient: Ded then 0% Emergency Room: Ded then 0% OP Lab & X-ray: Ded then 0% Radiology: Ded then 0% PRESCRIPTIONS Retail: $10, $35, $70; Specialty: $75/$250 Mail Order: $25, $87.50, $175; No Specialty Retail: $10, $35, $70; Specialty: $75/$250 Mail Order: $25, $87.50, $175; No Specialty Retail: Ded then 0% Mail Order: Ded then 0% OUT-OF-POCKET MAXIMUM Individual: $6,550 Family: $13,000 Individual: $5,000 Family: $10,000 Individual: $6,500 Family: $13,000 To view more about the medical benefits offered please click the link that retains to your location: To view your 2025 EVHC Welcome Guide for Salus Healthcare CA Employees, click here To view your 2025 EVHC Welcome Guide for Salus Healthcare Out-of-State Employees, click here PPO - In Network *Deductible applies first. The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. Review Plan SBC’s PPO EPO - In Network HDHP - In Network (HSA Eligible) EPO HDHP Find A Provider

5 HEALTH SAVINGS ACCOUNT (HSA) An HSA allows you to use before tax dollars to reimburse yourself for eligible out-of-pocket medical expenses for you, your spouse and your dependents, which in turn saves you on taxes and increases your spendable income. HSA’s have many benefits such as: • An HSA is yours. Funds in your HSA account stay with you, even if you change jobs. • Contribute tax free. An HSA reduces your taxable income. The money is tax free both when you put it in and when you take it out to cover qualified medical expenses. • Grow funds tax free. An HSA grows with you. When your HSA account balance reaches the minimum balance requirement, your funds can be invested in mutual funds yielding tax-free earnings. • Spend tax free. Withdrawals used for eligible expenses are tax free. • Funds can be withdrawn anytime for medical expenses. • After age 65, the funds can be used for any purpose, without penalty. • An HSA is only available if you select the HDHP Medical Plan If you meet the HSA requirements and choose to make HSA contributions, you must set up your own account with a financial institution of your choosing, make your contributions up to the IRS allowed amount, and address your tax consultant for tax credit. 2025 HSA Maximum Contributions $4,300 Individual $8,550 Family YOUR JOURNEY TO SAVINGS ?

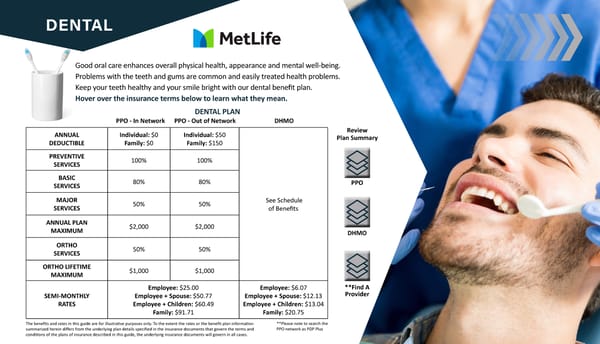

6 DENTAL Good oral care enhances overall physical health, appearance and mental well-being. Problems with the teeth and gums are common and easily treated health problems. Keep your teeth healthy and your smile bright with our dental benefit plan. Hover over the insurance terms below to learn what they mean. ANNUAL DEDUCTIBLE Individual: $0 Family: $0 Individual: $50 Family: $150 See Schedule of Benefits PREVENTIVE SERVICES 100% 100% BASIC SERVICES 80% 80% MAJOR SERVICES 50% 50% ANNUAL PLAN MAXIMUM $2,000 $2,000 ORTHO SERVICES 50% 50% ORTHO LIFETIME MAXIMUM $1,000 $1,000 SEMI-MONTHLY RATES Employee: $25.00 Employee + Spouse: $50.77 Employee + Children: $60.49 Family: $91.71 Employee: $6.07 Employee + Spouse: $12.13 Employee + Children: $13.04 Family: $20.75 DENTAL PLAN PPO - In Network PPO - Out of Network DHMO The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. Review Plan Summary PPO DHMO **Find A Provider **Please note to search the PPO network as PDP Plus

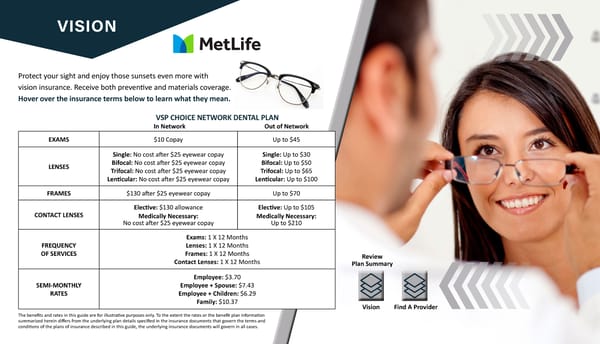

7 VISION Protect your sight and enjoy those sunsets even more with vision insurance. Receive both preventive and materials coverage. Hover over the insurance terms below to learn what they mean. EXAMS $10 Copay Up to $45 LENSES Single: No cost after $25 eyewear copay Bifocal: No cost after $25 eyewear copay Trifocal: No cost after $25 eyewear copay Lenticular: No cost after $25 eyewear copay Single: Up to $30 Bifocal: Up to $50 Trifocal: Up to $65 Lenticular: Up to $100 FRAMES $130 after $25 eyewear copay Up to $70 CONTACT LENSES Elective: $130 allowance Medically Necessary: No cost after $25 eyewear copay Elective: Up to $105 Medically Necessary: Up to $210 FREQUENCY OF SERVICES Exams: 1 X 12 Months Lenses: 1 X 12 Months Frames: 1 X 12 Months Contact Lenses: 1 X 12 Months SEMI-MONTHLY RATES Employee: $3.70 Employee + Spouse: $7.43 Employee + Children: $6.29 Family: $10.37 VSP CHOICE NETWORK DENTAL PLAN In Network Out of Network The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. Review Plan Summary Vision Find A Provider

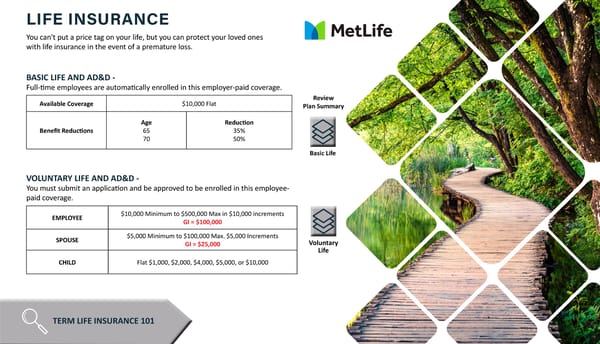

8 LIFE INSURANCE You can't put a price tag on your life, but you can protect your loved ones with life insurance in the event of a premature loss. BASIC LIFE AND AD&D - Full-time employees are automatically enrolled in this employer-paid coverage. Available Coverage $10,000 Flat Benefit Reductions Age 65 70 Reduction 35% 50% VOLUNTARY LIFE AND AD&D - You must submit an application and be approved to be enrolled in this employee- paid coverage. EMPLOYEE $10,000 Minimum to $500,000 Max in $10,000 increments GI = $100,000 SPOUSE $5,000 Minimum to $100,000 Max. $5,000 Increments GI = $25,000 CHILD Flat $1,000, $2,000, $4,000, $5,000, or $10,000 TERM LIFE INSURANCE 101 Review Plan Summary Basic Life Voluntary Life

9 VOLUNTARY BENEFITS Even with medical insurance, you could still be subject to unexpected out-of-pocket expenses in the form of copays, deductible, and coinsurance. These Voluntary Benefits provide lump sum payments to be used towards your health care expenses, or however you see fit. ACCIDENT INSURANCE CRITICAL ILLNESS HOSPITAL INDEMNITY Click on the icons to the right to learn more about each of these benefits.

10 RETIREMENT BENEFITS The key to saving for retirement is to start early and stay committed. Making the choice to invest in yourself by contributing to your employer sponsored retirement plan is a decision that may have a big impact on your ability to retire confidently. CONTRIBUTION TYPE: 401(k) Your plan includes a multitude of benefits including: • Making savings easier through automatic payroll deductions • Pre-Tax saving (up to $23,000, $7,500 catch-up for those 50+ in 2024) • Investment flexibility allowing you to be Hands-on or Hands-off • Life event flexibility to adjust your contribution rate and your investment approach TAX SAVINGS EASE OF SAVINGS BENEFITS COMPOUNDING COMBINE ACCOUNTS TRANSFER SAVINGS 401(k) Flyer

11 BENEFITHUB You now have exclusive access to amazing Cash Back offers on thousands of the discounts you love. Take advantage of savings in a variety of categories, including: • Travel • Auto • Electronics • Apparel • Education • Entertainment • Restaurants • Health & Wellness • Beauty & Spa • Sports & Outdoors It’s Easy to Sign Up and Save! Log in at: companyperks.benefithub.com Need to Register? • Go to: companyperks.benefithub.com • Click on any Deal • Complete Registration Questions? Call: 1-866-664-4621 or email: [email protected] Benefits Flyer

12 CONTACT INFORMATION Anthem 1-800-331-1476 https://www.anthem.com/ca/contact-us Ascensus 844-749-9981 www.ascensus.com Sunny Song 949-390-7308 [email protected] Metlife 800-638-5433 www.metlife.com Metlife 800-638-5433 www.metlife.com Metlife 800-638-5433 www.metlife.com MEDICAL 401(K) HR CONTACT DENTAL LIFE INSURANCE VISION

13 VIEW NOTICES EMPLOYEE NOTICES Please review the following required employee notices detailing your rights and options. You can also request a paper copy of any of these notices at any time.