Dash Delivery Benefits Guide 2026

This guide from Dash Delivery outlines the employee benefits for the plan year October 1st through September 30th, 2026.

2026 Benefits Guide YOUR BENEFITS JOURNEY Plan Year: Oct 1 st - Sept 30 th

S TA R T S H E R E Y O U R J O U R N E Y T O HOW TO USE THIS GUIDE When you see the icons below, click to link out to websites, download documents, or learn more! ? Carrier Logos Learn More ENROLLMENT

ENROLLMENT & ELIGIBILITY Employee Eligibility All full-time employees working 30 or more hours per week are eligible for company offered benefit plans after one month following their date of hire. Dependent Eligibility Employees who are eligible to participate in the Dash Delivery Inc. benefit program may also enroll their dependents. For the purposes of our benefit plans, your dependents are defined as follows: Your spouse or domestic partner Your dependent children to age 26 Mid-Year Changes Once your enrollment window closes, the only time you are allowed to make changes to your benefits elections in the middle of the year is if you experience a qualifying life event. Examples may include getting married or divorced, having a baby or adopting, or gaining or losing coverage. You must notify Human Resources within 30 days of qualifying life event to be eligible to change your elections. Your Human Resource Contact: Chris McCormick chris@dashdelivery.net 541-665-3274 ENROLL HERE

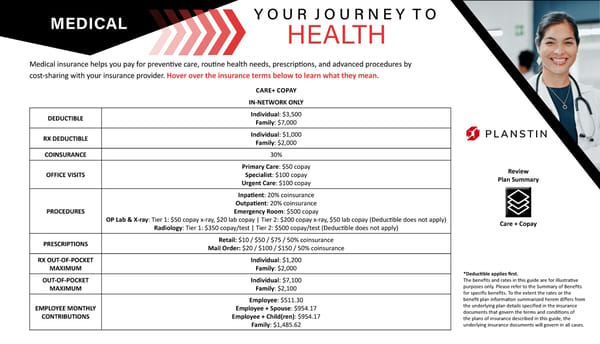

MEDICAL Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Hover over the insurance terms below to learn what they mean. Y O U R J O U R N E Y T O HEALTH CARE+ COPAY IN-NETWORK ONLY DEDUCTIBLE Individual : $3,500 Family : $7,000 RX DEDUCTIBLE Individual : $1,000 Family : $2,000 COINSURANCE 30% OFFICE VISITS Primary Care : $50 copay Specialist : $100 copay Urgent Care : $100 copay PROCEDURES Inpatient : 20% coinsurance Outpatient : 20% coinsurance Emergency Room : $500 copay OP Lab & X-ray : Tier 1: $50 copay x-ray, $20 lab copay | Tier 2: $200 copay x-ray, $50 lab copay (Deductible does not apply) Radiology : Tier 1: $350 copay/test | Tier 2: $500 copay/test (Deductible does not apply) PRESCRIPTIONS Retail: $10 / $50 / $75 / 50% coinsurance Mail Order: $20 / $100 / $150 / 50% coinsurance RX OUT-OF-POCKET MAXIMUM Individual : $1,200 Family : $2,000 OUT-OF-POCKET MAXIMUM Individual : $7,100 Family : $2,100 EMPLOYEE MONTHLY CONTRIBUTIONS Employee : $511.30 Employee + Spouse : $954.17 Employee + Child(ren) : $954.17 Family : $1,485.62 *Deductible applies first. The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. Review Plan Summary Care + Copay

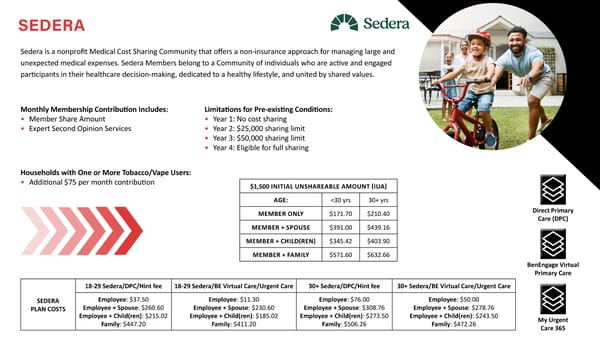

SEDERA Sedera is a nonprofit Medical Cost Sharing Community that offers a non-insurance approach for managing large and unexpected medical expenses. Sedera Members belong to a Community of individuals who are active and engaged participants in their healthcare decision-making, dedicated to a healthy lifestyle, and united by shared values. $1,500 INITIAL UNSHAREABLE AMOUNT (IUA) AGE: <30 yrs 30+ yrs MEMBER ONLY $171.70 $210.40 MEMBER + SPOUSE $391.00 $439.16 MEMBER + CHILD(REN) $345.42 $403.90 MEMBER + FAMILY $571.60 $632.66 Monthly Membership Contribution Includes: Member Share Amount Expert Second Opinion Services Households with One or More Tobacco/Vape Users: Additional $75 per month contribution Limitations for Pre-existing Conditions: Year 1: No cost sharing Year 2: $25,000 sharing limit Year 3: $50,000 sharing limit Year 4: Eligible for full sharing Direct Primary Care (DPC) BenEngage Virtual Primary Care My Urgent Care 365 SEDERA PLAN COSTS 18-29 Sedera/DPC/Hint fee 18-29 Sedera/BE Virtual Care/Urgent Care 30+ Sedera/DPC/Hint fee 30+ Sedera/BE Virtual Care/Urgent Care Employee : $37.50 Employee + Spouse : $260.60 Employee + Child(ren) : $215.02 Family : $447.20 Employee : $11.30 Employee + Spouse : $230.60 Employee + Child(ren) : $185.02 Family : $411.20 Employee : $76.00 Employee + Spouse : $308.76 Employee + Child(ren) : $273.50 Family : $506.26 Employee : $50.00 Employee + Spouse : $278.76 Employee + Child(ren) : $243.50 Family : $472.26

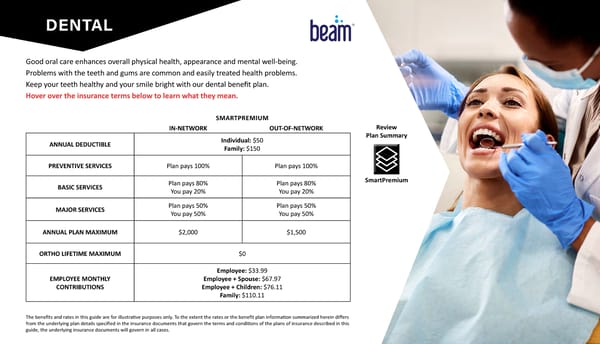

DENTAL Good oral care enhances overall physical health, appearance and mental well-being. Problems with the teeth and gums are common and easily treated health problems. Keep your teeth healthy and your smile bright with our dental benefit plan. Hover over the insurance terms below to learn what they mean. SMARTPREMIUM IN-NETWORK OUT-OF-NETWORK ANNUAL DEDUCTIBLE Individual: $50 Family: $150 PREVENTIVE SERVICES Plan pays 100% Plan pays 100% BASIC SERVICES Plan pays 80% You pay 20% Plan pays 80% You pay 20% MAJOR SERVICES Plan pays 50% You pay 50% Plan pays 50% You pay 50% ANNUAL PLAN MAXIMUM $2,000 $1,500 ORTHO LIFETIME MAXIMUM $0 EMPLOYEE MONTHLY CONTRIBUTIONS Employee: $33.99 Employee + Spouse: $67.97 Employee + Children: $76.11 Family: $110.11 The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. SmartPremium Review Plan Summary

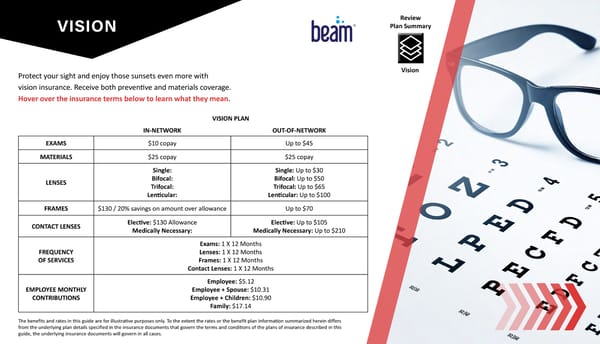

VISION Protect your sight and enjoy those sunsets even more with vision insurance. Receive both preventive and materials coverage. Hover over the insurance terms below to learn what they mean. VISION PLAN IN-NETWORK OUT-OF-NETWORK EXAMS $10 copay Up to $45 MATERIALS $25 copay $25 copay LENSES Single: Bifocal: Trifocal: Lenticular: Single: Up to $30 Bifocal: Up to $50 Trifocal: Up to $65 Lenticular: Up to $100 FRAMES $130 / 20% savings on amount over allowance Up to $70 CONTACT LENSES Elective: $130 Allowance Medically Necessary: Elective: Up to $105 Medically Necessary: Up to $210 FREQUENCY OF SERVICES Exams: 1 X 12 Months Lenses: 1 X 12 Months Frames: 1 X 12 Months Contact Lenses: 1 X 12 Months EMPLOYEE MONTHLY CONTRIBUTIONS Employee: $5.12 Employee + Spouse: $10.31 Employee + Children: $10.90 Family: $17.14 The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases. Vision Review Plan Summary

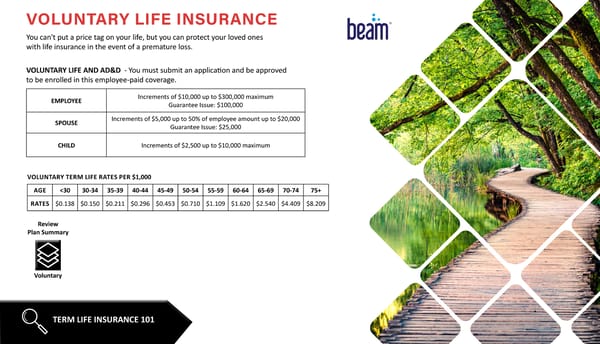

VOLUNTARY LIFE INSURANCE You can't put a price tag on your life, but you can protect your loved ones with life insurance in the event of a premature loss. VOLUNTARY LIFE AND AD&D - You must submit an application and be approved to be enrolled in this employee-paid coverage. EMPLOYEE Increments of $10,000 up to $300,000 maximum Guarantee Issue: $100,000 SPOUSE Increments of $5,000 up to 50% of employee amount up to $20,000 Guarantee Issue: $25,000 CHILD Increments of $2,500 up to $10,000 maximum TERM LIFE INSURANCE 101 Voluntary Review Plan Summary AGE <30 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75+ RATES $0.138 $0.150 $0.211 $0.296 $0.453 $0.710 $1.109 $1.620 $2.540 $4.409 $8.209 VOLUNTARY TERM LIFE RATES PER $1,000

VOLUNTARY BENEFITS Even with medical insurance, you could still be subject to unexpected out-of-pocket expenses in the form of copays, deductible, and coinsurance. These Voluntary Benefits provide lump sum payments to be used towards your health care expenses, or however you see fit. ACCIDENT INSURANCE CRITICAL ILLNESS HOSPITAL INDEMNITY Hover over the icons to the right to learn more about each of these benefits.

BenEngage Flyer BENENGAGE BenEngage is a benefits support and concierge service for employees, offering guidance on health insurance, benefits education, and assistance with complex healthcare and billing issues. They provide personalized support to help employees and their families understand and utilize their benefits, acting as an extension of their employers HR department. BenEngage Services: Benefits Concierge Service: Employees can contact BenEngage with questions about their benefits, claims, and healthcare resources. Plan Selection Guidance: BenEngage helps employees choose health insurance plans that best fit their individual and family needs. Educational Materials: They provide resources to help employees understand their coverage options. Complex Bill Resolution: BenEngage specialists assist with untangling complex medical bills and working with providers and insurance partners for resolution. Employee Advocacy: They act as advocates for employees to help them utilize their healthcare resources efficiently.

CONTACT INFORMATION Planstin 888-920-7526 www.planstin.com Beam 800-648-1179 www.beambenefits.com Beam 800-648-1179 www.beambenefits.com Beam 800-648-1179 www.beambenefits.com Member Support 855-973-3372 memberservices@sedera.com Chris McCormick 541-665-3274 chris@dashdelivery.net MEDIC A L D E NTA L VISION LIFE INS U R A N C E S E D E R A HR CONTAC T Beam 800-648-1179 www.beambenefits.com ACCIDENT/CI/HOSPITAL Dash Benefits Concierge 216-545-9963 dash@benengage.com A D D I T I O NA L CONTAC T

VIEW NOTICES EMPLOYEE NOTICES Please review the following required employee notices detailing your rights and options. You can also request a paper copy of any of these notices at any time.