Total Education Solutions Benefits Guide 2025

2025 Benefits Guide YOUR BENEFITS JOURNEY st st Plan Year: Jan 1 - Dec 31

Y O U R J O U R N E Y ENROLLMENT T O STARTS HERE HOW TO USE THIS GUIDE When you see the icons below, click to link out to websites, download documents, or learn more! Carrier Learn ? Logos More

ENROLLMENT & ELIGIBILITY Employee Eligibility All full-time employees working 30 or more hours per week are eligible for company offered benefit plans on the first of the month following 30 days NAYYA of employment. BENEFITS Dependent Eligibility GUIDE Employees who are eligible to participate in the Total Education Solutions benefit program may also enroll their dependents. For the purposes of our benefit plans, your dependents are defined as follows: ENROLL • Your spouse or domestic partner HERE • Your dependent children to age 26 Mid-Year Changes Once your enrollment window closes, the only time you are allowed to make changes to your benefits elections in the middle of the year is if you experience a qualifying life event. Examples may include getÝng married or divorced, having a baby or adopting, or gaining or losing coverage. You must notify Human Resources within 30 days of qualifying life event to be eligible to change your elections. Your Human Resource Contacts: Adriana Avitia Cody Iverson aavitia@tesidea.com civerson@tesidea.com 323-341-5883 213-607-4356

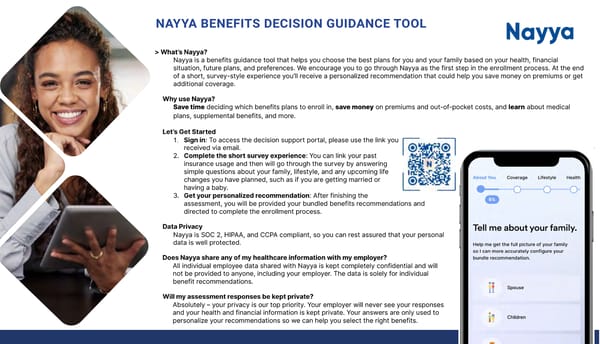

Nayya NAYYA BENEFITS DECISION GUIDANCE TOOL >What’sNayya? Nayyaisabenefitsguidancetool that helps you choose the best plans for you and your family based on your health, financial situation, future plans, and preferences. We encourage you to go through Nayya as the first step in the enrollment process. At the end of a short, survey-style experience you’ll receive a personalized recommendation that could help you save money on premiums or get additional coverage. WhyuseNayya? Savetimedecidingwhichbenefitsplanstoenroll in, savemoney on premiums and out-of-pocket costs, and learn about medical plans, supplemental benefits, and more. Let’s GetStarted 1. Signin: To access the decision support portal, please use the link you received via email. 2. Completetheshortsurveyexperience:Youcanlinkyourpast insurance usage and then will go through the survey by answering simple questions about your family, lifestyle, and any upcoming life f you are getting married or changesyouhaveplanned,suchasi having a baby. 3. Getyourpersonalizedrecommendation:Afterfinishing the assessment, you will be provided your bundled benefits recommendations and directed to complete the enrollment process. DataPrivacy NayyaisSOC2,HIPAA,andCCPAcompliant,soyoucanrestassuredthatyourpersonal data is well protected. DoesNayyashareanyofmyhealthcareinformationwithmyemployer? All individual employee data shared with Nayya is kept completely confidential and will not be provided to anyone, including your employer. The data is solely for individual benefit recommendations. Willmyassessmentresponsesbekeptprivate? Absolutely – your privacy is our top priority. Your employer will never see your responses andyourhealthandfinancial information is kept private. Your answers are only used to personalize your recommendations so we can help you select the right benefits.

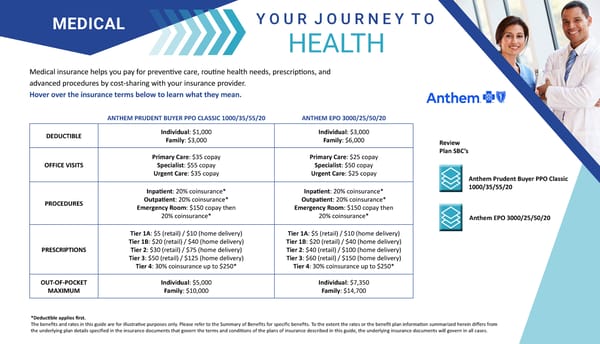

MEDICAL Y O U R J O U R N E Y T O HEALTH Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Hover over the insurance terms below to learn what they mean. ANTHEM PRUDENT BUYER PPO CLASSIC 1000/35/55/20 ANTHEM EPO 3000/25/50/20 DEDUCTIBLE Individual: $1,000 Individual: $3,000 Family: $3,000 Family: $6,000 Review Primary Care: $35 copay Primary Care: $25 copay Plan SBC’s OFFICE VISITS Specialist: $55 copay Specialist: $50 copay Urgent Care: $35 copay Urgent Care: $25 copay Anthem Prudent Buyer PPO Classic 1000/35/55/20 Inpatient: 20% coinsurance* Inpatient: 20% coinsurance* PROCEDURES Outpatient: 20% coinsurance* Outpatient: 20% coinsurance* Emergency Room: $150 copay then Emergency Room: $150 copay then 20% coinsurance* 20% coinsurance* Anthem EPO 3000/25/50/20 Tier 1A: $5 (retail) / $10 (home delivery) Tier 1A: $5 (retail) / $10 (home delivery) Tier 1B: $20 (retail) / $40 (home delivery) Tier 1B: $20 (retail) / $40 (home delivery) PRESCRIPTIONS Tier 2: $30 (retail) / $75 (home delivery) Tier 2: $40 (retail) / $100 (home delivery) Tier 3: $50 (retail) / $125 (home delivery) Tier 3: $60 (retail) / $150 (home delivery) Tier 4: 30% coinsurance up to $250* Tier 4: 30% coinsurance up to $250* OUT-OF-POCKET Individual: $5,000 Individual: $7,350 MAXIMUM Family: $10,000 Family: $14,700 *Deductible applies first. The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

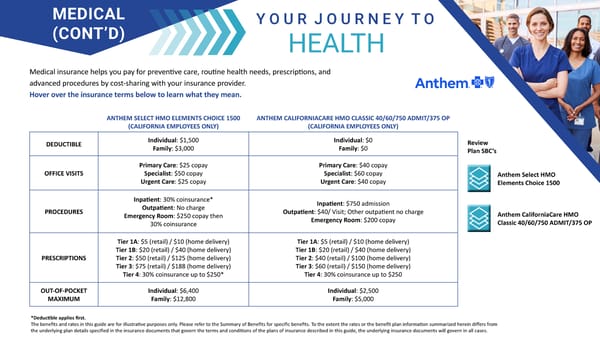

MEDICAL Y O U R J O U R N E Y T O (CONT’D) HEALTH Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and advanced procedures by cost-sharing with your insurance provider. Hover over the insurance terms below to learn what they mean. ANTHEM SELECT HMO ELEMENTS CHOICE 1500 ANTHEM CALIFORNIACARE HMO CLASSIC 40/60/750 ADMIT/375 OP (CALIFORNIA EMPLOYEES ONLY) (CALIFORNIA EMPLOYEES ONLY) DEDUCTIBLE Individual: $1,500 Individual: $0 Review Family: $3,000 Family: $0 Plan SBC’s Primary Care: $25 copay Primary Care: $40 copay OFFICE VISITS Specialist: $50 copay Specialist: $60 copay Anthem Select HMO Urgent Care: $25 copay Urgent Care: $40 copay Elements Choice 1500 Inpatient: 30% coinsurance* Inpatient: $750 admission PROCEDURES Outpatient: No charge Outpatient: $40/ Visit; Other outpatient no charge Anthem CaliforniaCare HMO Emergency Room: $250 copay then Emergency Room: $200 copay Classic 40/60/750 ADMIT/375 OP 30% coinsurance Tier 1A: $5 (retail) / $10 (home delivery) Tier 1A: $5 (retail) / $10 (home delivery) Tier 1B: $20 (retail) / $40 (home delivery) Tier 1B: $20 (retail) / $40 (home delivery) PRESCRIPTIONS Tier 2: $50 (retail) / $125 (home delivery) Tier 2: $40 (retail) / $100 (home delivery) Tier 3: $75 (retail) / $188 (home delivery) Tier 3: $60 (retail) / $150 (home delivery) Tier 4: 30% coinsurance up to $250* Tier 4: 30% coinsurance up to $250 OUT-OF-POCKET Individual: $6,400 Individual: $2,500 MAXIMUM Family: $12,800 Family: $5,000 *Deductible applies first. The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

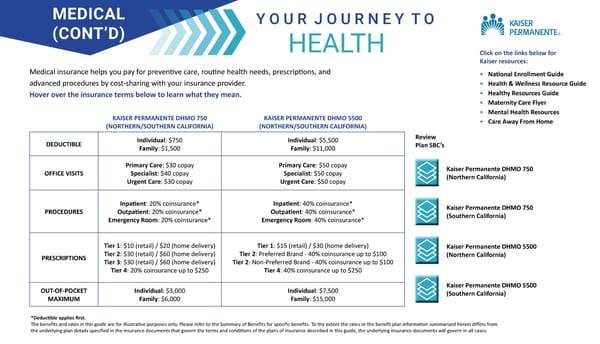

MEDICAL Y O U R J O U R N E Y T O (CONT’D) HEALTH Click on the links below for Kaiser resources: Medical insurance helps you pay for preventive care, routine health needs, prescriptions, and • National Enrollment Guide advanced procedures by cost-sharing with your insurance provider. • Health & Wellness Resource Guide Hover over the insurance terms below to learn what they mean. • Healthy Resources Guide • Maternity Care Flyer KAISER PERMANENTE DHMO 750 KAISER PERMANENTE DHMO 5500 • Mental Health Resources (NORTHERN/SOUTHERN CALIFORNIA) (NORTHERN/SOUTHERN CALIFORNIA) • Care Away From Home Individual: $750 Individual: $5,500 Review DEDUCTIBLE Family: $1,500 Family: $11,000 Plan SBC’s Primary Care: $30 copay Primary Care: $50 copay Kaiser Permanente DHMO 750 OFFICE VISITS Specialist: $40 copay Specialist: $50 copay (Northern California) Urgent Care: $30 copay Urgent Care: $50 copay Inpatient: 20% coinsurance* Inpatient: 40% coinsurance* Kaiser Permanente DHMO 750 PROCEDURES Outpatient: 20% coinsurance* Outpatient: 40% coinsurance* (Southern California) Emergency Room: 20% coinsurance* Emergency Room: 40% coinsurance* Tier 1: $10 (retail) / $20 (home delivery) Tier 1: $15 (retail) / $30 (home delivery) Kaiser Permanente DHMO 5500 PRESCRIPTIONS Tier 2: $30 (retail) / $60 (home delivery) Tier 2: Preferred Brand - 40% coinsurance up to $100 (Northern California) Tier 3: $30 (retail) / $60 (home delivery) Tier 2: Non-Preferred Brand - 40% coinsurance up to $100 Tier 4: 20% coinsurance up to $250 Tier 4: 40% coinsurance up to $250 OUT-OF-POCKET Individual: $3,000 Individual: $7,500 Kaiser Permanente DHMO 5500 MAXIMUM Family: $6,000 Family: $15,000 (Southern California) *Deductible applies first. The benefits and rates in this guide are for illustrative purposes only. Please refer to the Summary of Benefits for specific benefits. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

EMPLOYEE ASSISTANCE WELLBEING PROGRAM (EAP) If you think your physical health alone is related to your overall performance, think again. Total Wellbeing as a whole is comprised of 5 elements: physical, financial, communal, You encounter more than just health concerns throughout emotional, and purpose. To build your overall wellbeing, you your life. Manage life’s curveballs with a confidential and have to make sure all of these elements are being “exercised”. complimentary program designed to provide counseling, support, and resources for a variety of personal issues like stress and anxiety, relationship struggles, substance abuse, eldercare, financial worries and much more. Get the support you need today: EAP Flyer

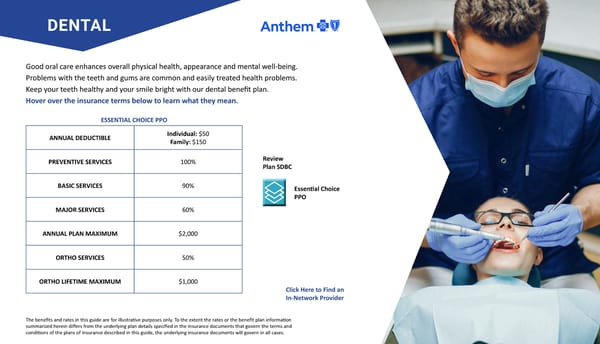

DENTAL Good oral care enhances overall physical health, appearance and mental well-being. Problems with the teeth and gums are common and easily treated health problems. Keep your teeth healthy and your smile bright with our dental benefit plan. Hover over the insurance terms below to learn what they mean. ESSENTIAL CHOICE PPO ANNUAL DEDUCTIBLE Individual: $50 Family: $150 PREVENTIVE SERVICES 100% Review Plan SDBC BASIC SERVICES 90% Essential Choice PPO MAJOR SERVICES 60% ANNUAL PLAN MAXIMUM $2,000 ORTHO SERVICES 50% ORTHO LIFETIME MAXIMUM $1,000 Click Here to Find an In-Network Provider The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

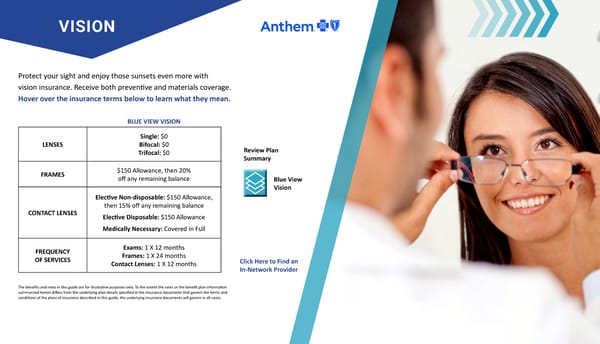

VISION Protect your sight and enjoy those sunsets even more with vision insurance. Receive both preventive and materials coverage. Hover over the insurance terms below to learn what they mean. BLUE VIEW VISION Single: $0 LENSES Bifocal: $0 Review Plan Trifocal: $0 Summary FRAMES $150 Allowance, then 20% off any remaining balance Blue View Vision Elective Non-disposable: $150 Allowance, then 15% off any remaining balance CONTACT LENSES Elective Disposable: $150 Allowance Medically Necessary: Covered in Full FREQUENCY Exams: 1 X 12 months OF SERVICES Frames: 1 X 24 months Click Here to Find an Contact Lenses: 1 X 12 months In-Network Provider The benefits and rates in this guide are for illustrative purposes only. To the extent the rates or the benefit plan information summarized herein differs from the underlying plan details specified in the insurance documents that govern the terms and conditions of the plans of insurance described in this guide, the underlying insurance documents will govern in all cases.

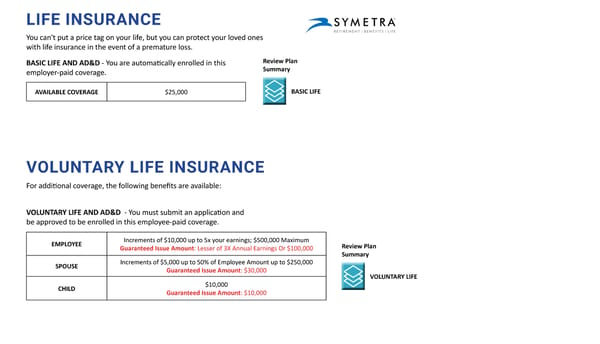

LIFE INSURANCE You can't put a price tag on your life, but you can protect your loved ones with life insurance in the event of a premature loss. BASIC LIFE AND AD&D - You are automatically enrolled in this Review Plan Summary employer-paid coverage. AVAILABLE COVERAGE $25,000 BASIC LIFE VOLUNTARY LIFE INSURANCE For additional coverage, the following benefits are available: VOLUNTARY LIFE AND AD&D - You must submit an application and be approved to be enrolled in this employee-paid coverage. EMPLOYEE Increments of $10,000 up to 5x your earnings; $500,000 Maximum Review Plan Guaranteed Issue Amount: Lesser of 3X Annual Earnings Or $100,000 Summary SPOUSE Increments of $5,000 up to 50% of Employee Amount up to $250,000 Guaranteed Issue Amount: $30,000 VOLUNTARY LIFE CHILD $10,000 Guaranteed Issue Amount: $10,000

DISABILITY Accidents and illnesses happen and often when we least expect them. Ensure you are financially prepared to stay afloat during a medical condition with disability insurance. VOLUNTARY SHORT-TERM DISABILITY Class 1: California Employees — STD Voluntary Class 2: Non-California Employees — STD Voluntary Review Plan BENEFIT Class 1: 20% of your earnings to a maximum of $1,600 a week Summaries Class 2: 60% of your earnings to a maximum of $1,600 a week CLASS 1: CALIFORNIA DURATION 12 Weeks for Sickness EMPLOYEES 12 weeks for Accident WAITING PERIOD Illness: 7 Days CLASS 2: NON-CALIFORNIA Accident: 7 Days EMPLOYEES VOLUNTARY LONG-TERM DISABILITY 100% employee paid BENEFIT 60% of your Earnings to a Maximum of $6,500 a Month Review Plan Summary DURATION 13 Weeks for Sickness 13 weeks for Accident LTD WAITING PERIOD Illness: 7 Days DISABILITY 101 Accident: 0 Days

VOLUNTARY BENEFITS ACCIDENT INSURANCE View Additional Information Here Even with medical insurance, you could still be subject to unexpected out-of-pocket expenses in the form of copays, deductible, and coinsurance. These Voluntary Benefits provide lump sum payments to be used towards your health care expenses, or however you see fit. Click on the icons to the right to learn more about each of these benefits. CRITICAL ILLNESS View Additional Information Here HOSPITAL INDEMNITY View Additional Information Here

CONTACT INFORMATION EAP MEDICAL MEDICAL Symetra Anthem Kaiser Permanente 1-800-796-3872 800-676-BLUE (2583) 1-800-464-4000 www.symetra.com/customer-service/ www.anthem.com healthy.kaiserpermanente.org/ how-can-we-help-you/email-us/ southern-california/support VISION DENTAL LIFE INSURANCE Anthem Symetra Anthem 800-676-BLUE (2583) 1-800-796-3872 800-676-BLUE (2583) www.anthem.com www.symetra.com/customer-service/ www.anthem.com how-can-we-help-you/email-us/ DISABILITY HR CONTACT ACCIDENT/CI/HOSPITAL Symetra Adriana Avitia Symetra 1-800-796-3872 323-341-5883 1-800-796-3872 www.symetra.com/customer-service/ aavitia@tesidea.com www.symetra.com/customer-service/ how-can-we-help-you/email-us/ how-can-we-help-you/email-us/ Cody Iverson 213-607-4356 civerson@tesidea.com

EMPLOYEE NOTICES Please review the following required employee notices detailing your rights and options. You can also request a paper copy of any of these notices at any time. VIEW NOTICES